Air Cargo Softens in 2022

After a stellar 2021, the weaker air cargo demand in 2022, is a result of multiple headwinds including inflation, Russia-Ukraine war disruptions, and the unusual strength of the US dollar

2021 had proved to be a stellar year for the air cargo industry showcasing a strong performance. Following its lead, 2022 did start alright for cargo, maintaining stability for half of the year and showing resilience for most of the second half. However, September onwards the demand began to soften. The International Air Transport Association (IATA) released data for November 2022 global air cargo markets showing that cargo demand softened as economic headwinds persisted.

From a year-to-date (YTD) perspective, the global air cargo industry has achieved 229.4 billion cargo tonne-kilometers (CTKs). Although this is 7.4 per cent lower than the same period in 2021, it still tracks close to the pre-pandemic level with only a 1.1 per cent contraction YTD compared with the same period in 2019. The weaker air cargo demand is a result of multiple headwinds. Inflation remains high, curtailing the spending capacity of households. The ongoing war in Ukraine disrupts trade flows, and the unusual strength of the US dollar makes commodities traded in US dollar more expensive in local currency terms. Although global goods trade growth remained positive, air cargo’s relative growth performance softened.

When the pandemic brought the aviation industry to a halt, cargo aviation had emerged to the forefront, handling the situation of constant transporting of medical aids and stranded passengers across countries. Many commercial airlines had also transitioned their carriers for cargo purposes. Though the demand for cargo had its moments of fluctuations through the time, 2021 had turned out to be an outstanding year for Air Cargo with a strong performance in December 2021 that witnessed the YoY going up 18.7 per cent. The data released by IATA for global air freight markets showed that full-year demand for air cargo had increased by 6.9 per cent in 2021, compared to 2019 (pre-covid levels) and 18.7 per cent compared to 2020 following a strong performance in December 2021.

However, the global demand, measured in CTKs, fell 13.7 per cent in November 2022 compared to November 2021 (-14.2 per cent for international operations). Capacity (measured in available cargo tonne-kilometers, ACTK) was 1.9 per cent below November 2021. This was the second year-on-year contraction following the first last month (in October) since April 2022. International cargo capacity decreased 0.1 per cent compared to November 2021. There was a lesser decline in overall demand (-10.1 per cent) compared to pre-COVID-19 levels (November 2019), but capacity was down 8.8 per cent.

Airlines’ reduced air cargo capacity was mainly a response to the supply imbalance that has emerged as demand had fallen year-on-year (YoY) since March. The industry seasonally adjusted (SA) cargo load factor (CLF) in November was 47.2 per cent, marking the fourth month-on-month decline in a row. Therefore, it is likely that global air cargo capacity will continue to decrease in the coming months.

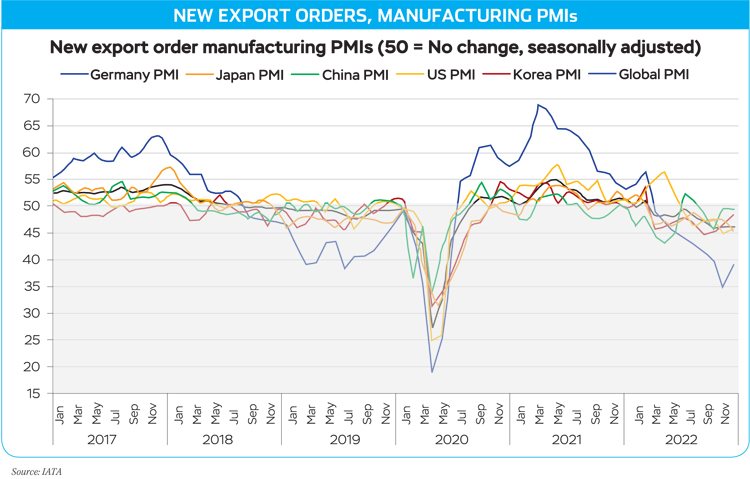

New export orders remained below the crucial 50 (no change) line for major economies, which has historically been a leading sign for air freight shipments. Global export orders remained unchanged from October, indicating that the global economy is still slowing. Germany witnessed the first increase in export orders since February 2022, indicating a return to normalcy following the months-long impact of the Ukraine conflict. Other major economies that had minor increases in export orders in November included the United States and South Korea, while Japan and China saw slightly fewer new export orders in November compared to October.

The factors in the 2022 operating environment that must be noted include:

- Global new export orders, a leading indicator of cargo demand, were stable in October. For major economies, new export orders are shrinking except in Germany, the US, and South Korea, where they grew.

- Global goods trade expanded by 3.3 per cent in October. Given the softening in air cargo demand, this suggests that maritime cargo was the primary beneficiary.

- The US dollar has appreciated sharply, adding cost pressure as many costs are denominated in US dollars. This includes jet fuel, which is already at elevated levels.

- The Consumer Price Index for G7 countries decreased from 7.8 per cent in October to 7.4 per cent in November, the largest month-on-month decline in 2022. Inflation in producer (input) prices reduced to 12.7 per cent in November, its lowest level so far in 2022.

“Air cargo performance softened in November, which is traditionally the peak season. Resilience in the face of economic uncertainties is demonstrated with demand being relatively stable on a month-to-month basis. But market signals are mixed. November presented several indicators with upside potential: oil prices stabilised, inflation slowed and there was a slight expansion in goods traded globally. But shrinking export orders globally and China’s rising COVID cases are cause for careful monitoring,” said Willie Walsh, IATA’s Director General.

AIR CARGO MARKET OUTLOOK IN NOVEMBER 2022

Air Cargo Market in Detail – November 2022 | World Share¹ | CTK | ACTK | CLF(%-PT)² | CLF(Level)³ |

|---|---|---|---|---|---|

Total Market | 100.0% | -13.7% | -1.9% | -6.7% | 49.1% |

| Africa | 1.9% | -6.3% | -11.4% | 2.5% | 45.8% |

| Asia Pacific | 32.6% | -18.6% | -4.5% | -9.5% | 54.5% |

| Europe | 22.8% | -16.5% | -6.6% | -6.8% | 56.9% |

| Latin America | 2.2% | 2.8% | 19.9% | -6.4% | 38.2% |

| Middle East | 13.4% | -14.7% | 2.1% | -9.3% | 47.5% |

| North America | 27.2% | -6.6% | 0.3% | -3.1% | 41.9% |

¹ % of industry CTKs in 2021; ²Year-on-year change in load factor; ³Load Factor Level

Source: IATA

REGIONAL REPORT FROM NOVEMBER

Industrywide international CTKs contracted by 14.2 per cent YoY in November, compared with a 13.7 per cent YoY decline in the previous month. This is the biggest drop in YoY growth this year. In the region-wise comparison, Asia-Pacific carriers were the most impacted ones with maximum downfall especially amid the Russia-Ukraine war while Latin American carriers had a fairly positive time with a slight increase in the volumes.

Asia-Pacific airlines saw their air cargo volumes decrease by 18.6 per cent in November 2022 compared to the same month in 2021. This was the worst performance of all regions and a decline in performance compared to October (-14.7 per cent). Airlines in the region continue to be impacted by lower levels of trade and manufacturing activity and disruptions in supply chains due to China’s rising COVID cases. Available capacity in the region decreased by 4.5 per cent compared to 2021.

North American carriers posted a 6.6 per cent decrease in cargo volumes in November 2022 compared to the same month in 2021. This was an improvement in performance compared to October (-8.6 per cent). Capacity increased 0.3 per cent compared to November 2021.

Airlines’ reduced air cargo capacity was mainly a response to the supply imbalance that has emerged as demand had fallen year-on-year (YoY) since March

European carriers saw a 16.5 per cent decrease in cargo volumes in November 2022 compared to the same month in 2021. This was an improvement in performance compared to October (-18.8 per cent), thanks to the stronger new export orders in Germany. Airlines in the region continue to be most affected by the war in Ukraine. High inflation levels, most notably in Turkey, also affected volumes. Capacity decreased 6.6 per cent in November 2022 compared to November 2021.

Middle Eastern carriers experienced a 14.7 per cent year-on-year decrease in cargo volumes in November 2022. This was a marginal improvement to the previous month (-15.0 per cent). Cargo volumes to/from Europe impacted the region’s performance, registering a 16.3 per cent year-on-year decline in November. Capacity increased 2.1 per cent compared to November 2021.

Latin American carriers reported a 2.8 per cent increase in cargo volumes in November 2022 compared to November 2021. This was the strongest performance of all regions, and a significant improvement in performance compared to October (-1.4 per cent). Capacity in November was up 2.8 per cent compared to the same month in 2021.

African airlines saw cargo volumes decrease by 6.3 per cent in November 2022 compared to November 2021. This was an improvement in performance compared to the previous month (-8.3 per cent). Capacity was 11.4 per cent below November 2021 levels.

After the invasion of Ukraine, the year’s promising start for air cargo carriers started to turn negative. Since April, rates have been slowly declining as the war, high energy prices, inflation, huge retail inventories, and a revived consumer focus on services have slowed demand for products. Lockdowns that were implemented widely in important Chinese manufacturing hubs reduced plant output and decreased exports shipped by air and sea carriers. However, the market conditions this year are more of a downtrend than a crash, as business is still relatively alright. Full-year demand is likely to be roughly 6 per cent lower than in 2019, but increased prices are a result of less passenger belly capacity, airport congestion, and a manpower shortage in the sector. Even after COVID, rates are still roughly 80 per cent better.

According to IATA, cargo capacity is still roughly 8 per cent lower than in 2019 since passenger airlines haven’t fully restarted all of the flights they had before the epidemic, and express delivery business is also falling. FedEx, UPS, DHL, and Amazon have also experienced slower growth. FedEx has responded by reducing 40 daily flights and grounding 16 widebody planes by the first quarter of 2023. Amazon Air did not add as many new routes to its network this fall as it had in prior quarters, and it is reportedly planning to carry third-party goods for the first time.

The downtrend is expected to continue in 2023 given the market conditions, and how the air cargo industry comes out of this and strike resiliency will be something to watch out for.