Airlines to Return to Profit in 2023: IATA

Even though the road to recovery is still long, turning the corner towards profitability is a significant feat considering the scale of the financial and economic damage caused by the pandemic

The airlines have survived the COVID-19 crisis donning the badge of resilience. 2022 almost became synonymous with a comeback for the industry as travel restarted. Building on that, financial recovery for the airlines is expected in 2023, further making way for the first industry profit since 2019. That is a significant feat considering the scale of the financial and economic damage caused by the pandemic. However, the road to recovery is still long. “Many airlines are sufficiently profitable to attract the capital needed to drive the industry forward but many others are struggling for various reasons. These include inconvenient regulation, high costs, inconsistent government policies, inefficient infrastructure and a value chain where the rewards of connecting the world are not equitably distributed,” said Willie Walsh, Director General of the International Air Transport Association (IATA).

In 2023 IATA expects the airline industry to tip into profitability. Airlines are anticipated to earn a global net profit of $4.7 billion on revenues of $779 billion (0.6 per cent net margin) in spite of growing economic uncertainties as global GDP growth slows to 1.3 per cent ( from 2.9 per cent in 2022). “Despite the economic uncertainties, there are plenty of reasons to be optimistic about 2023. Lower oil price inflation and continuing pent-up demand should help to keep costs in check as the strong growth trend continues. At the same time, with such thin margins, even an insignificant shift in any one of these variables has the potential to shift the balance into negative territory. Vigilance and flexibility will be key,” Walsh added.

The main drivers of this profit identified by IATA include:

- Passengers: The passenger business is expected to generate revenues of $522 billion as passenger demand is expected to reach 85.5 per cent of 2019 levels over the course of 2023. Despite the uncertainties of China’s Zero COVID policies, which are constraining both domestic and international markets, passenger numbers are expected to surpass the four billion mark for the first time since 2019, with 4.2 billion travelers expected to fly. Passengers are taking advantage of the return of their freedom to travel. A recent IATA poll of travelers in 11 global markets revealed that nearly 70 per cent are traveling as much or more than they did prior to the pandemic. And, while the economic situation is concerning to 85 per cent of travelers, 57 per cent have no intention to curb their travel habits.

- Cargo: Cargo industry had a comparatively upbeat time during the pandemic especially with a lot of medical equipment being transported. However, IATA expects the cargo markets to come under increased pressure in 2023. Revenues are expected to be $149.4 billion, which is $52 billion less than 2022 but still $48.6 billion stronger than 2019. With economic uncertainty, cargo volumes are expected to decrease to 57.7 million tonnes, from a peak of 65.6 million tonnes in 2021. As belly capacity grows in line with the recovery in passenger markets, yields are expected to take a significant step back and with that IATA expects a fall of 22.6 per cent in cargo yields, mostly in the latter part of the year when the impact of inflation-cooling measures are expected to bite. Cargo yields grew by 52.5 per cent in 2020, 24.2 per cent in 2021 and 7.2 per cent in 2022.

- Costs: Overall costs are expected to grow by 5.3 per cent to $776 billion. That growth is expected to be 1.8 percentage points below revenue growth, thus supporting a return to profitability. However, the shortages of labour, skill and capacity as well as infrastructure costs will continue to maintain cost pressures.

RISKS

Though overall the needle points towards positive, the economic and geopolitical environment presents several potential risks to the 2023 outlook. While indications are that there could be an easing of aggressive inflation-fighting interest rate hikes from early 2023, the risk of some economies falling into recession continues. Such a slowdown could affect demand for both passenger and cargo services. However, it could come with some mitigation in the form of lower oil prices.

The IATA outlook also anticipates a gradual re-opening of China to international traffic and the easing of domestic COVID-19 restrictions progressively from the second half of 2023. A prolongation of China’s Zero COVID policies would adversely affect the outlook added to the possible increase in infrastructure charges or taxes to support sustainability efforts. Airlines must remain vigilant to any such increases, given how thin airline profitability is. Each passenger carried is expected to contribute on average just $1.11 to the industry’s net profit.

LOOKING BACK AT 2022

IATA underlines that improved prospects for 2022 stem largely from strengthened yields and strong cost control in the face of rising fuel prices. Passenger yields are expected to grow by 8.4 per cent (up from the 5.6 per cent anticipated in June). Propelled by that strength, passenger revenues are expected to grow to $438 billion (up from $239 billion in 2021).

Air cargo revenues played a key role in cutting losses with revenues expected to reach $201.4 billion. That is an improvement compared with the June forecast, largely unchanged from 2021, and more than double the $100.8 billion earned in 2019. Overall revenues are expected to grow by 43.6 per cent compared to 2021, reaching an estimated $727 billion.

A recent IATA poll of travelers in 11 global markets revealed that nearly 70 per cent are traveling as much or more than they did prior to the pandemic

Most other factors evolved in a negative manner following a downgrade of GDP growth expectations (from 3.4 per cent in June to 2.9 per cent), and delays in removing COVID-19 restrictions in several markets, particularly China. IATA’s June forecast anticipated that passenger traffic would reach 82.4 per cent of pre-crisis levels in 2022, but it now appears that the industry demand recovery will reach 70.6 per cent of pre-crisis levels. Cargo, on the other hand, was anticipated to exceed 2019 levels by 11.7 per cent, but that is now more likely to be moderated to 98.4 per cent of 2019 levels.

On the cost side, jet kerosene prices are expected to average $138.8/barrel for the year, considerably higher than the $125.5/barrel expected in June. That reflects higher oil prices exaggerated by a jet crack spread that is well-above historic averages. Even with lower demand leading to reduced consumption, this raised the industry’s fuel bill to $222 billion (well above the $192 billion anticipated in June).

That airlines were able to cut their losses in 2022, in the face of rising costs, labour shortages, strikes, operational disruptions in many key hubs and growing economic uncertainty speaks volumes about peoples’ desire and need for connectivity. “With some key markets like China retaining restrictions longer than anticipated, passenger numbers fell somewhat short of expectation. The year ended at about 70 per cent of 2019 passenger volumes. But with yield improvement in both cargo and passenger businesses, airlines will reach the cusp of profitability,” said Walsh.

REGIONAL ROUND UP

All regions continue to observe improved financial performance since the depth of the pandemic losses seen in 2020.

In 2023, passenger demand growth of 6.4 per cent is expected to outpace capacity growth of 5.5 per cent in North America. Carriers in the region benefitted from fewer and shorter-lasting travel restrictions than many other countries and regions.

European carriers are expected to see a profit of $621 million in 2023. The war in Ukraine has curtailed the activities of some of the region’s carriers. Operational disruptions at some of the continent’s hubs are being resolved, but labour unrest continues at various locations.

Middle East carriers are expected to post a profit of $268 million in 2023. The region has benefitted from a certain degree of rerouting resulting from the war in Ukraine, and more significantly so from the pent-up travel demand using the region’s extensive global networks as international travel markets re-opened.

Over the year, Latin America is expected to serve 95.6 per cent of pre-crisis demand levels with 94.2 per cent of pre-crisis capacity. Latin America has shown buoyancy over the year, largely owing to the fact that many countries began lifting their COVID-19 travel restrictions in mid-year.

IATA expects the cargo markets to come under increased pressure in 2023; revenues are expected to be $52 billion less than 2022 but still $48.6 billion stronger than 2019

In 2023, passenger demand growth of 27.4 per cent is expected to outpace capacity growth of 21.9 per cent in Africa. Africa is particularly exposed to macro-economic headwinds which have increased the vulnerability of several economies and rendered connectivity more complex.

Over the year 2023, Asia-Pacific is expected to serve 70.8 per cent of pre-crisis demand levels with 75.5 per cent of pre-crisis capacity. Asia-Pacific is critically held back by the impact of China’s zero COVID policies on travel and the region’s losses are largely skewed by the performance of China’s airlines who face the full impact of this policy in both domestic and international markets.

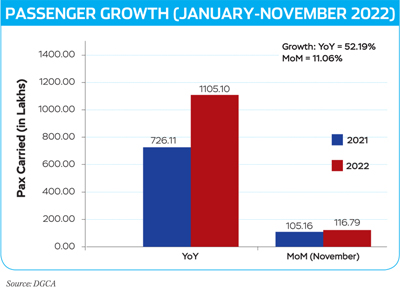

In India particularly, passengers carried by domestic airlines during January-November 2022 were 1,105.10 lakhs as against 726.11 lakhs during the corresponding period of previous year thereby registering annual growth of 52.19 per cent and monthly growth of 11.06 per cent according to a report by India’s Directorate General of Civil Aviation (DGCA).

The bottom line of the report underlines that the expected profits for 2023 are razor thin but it is incredibly significant that the corner has been turned to profitability. “The challenges that airlines will face in 2023, while complex, will fall into our areas of experience. The industry has built a great capability to adjust to fluctuations in the economy, major cost items like fuel prices, and passenger preference. We see this demonstrated in the decade of strengthening profitability following the 2008 Global Financial Crisis and ending with the pandemic. And encouragingly, there are plenty of jobs and the majority of people are confident to travel even with an uncertain economic outlook,” said Walsh.