Post-Pandemic Aviation in India

The pandemic is already over and there is a silver lining on the horizon that needs to be harnessed by the airlines to remain profitable

During the year 2019, a global pandemic struck the world wherein a virus named COVID–19 created an unprecedented disruption of modern life that had a cascading effect on civil aviation.

The impact of this disruption is visible even today. Air passengers today, due to occasional regulations and prudence, still maintain social distancing, enjoy limited work from home and avoid unnecessary air travel. The travel restrictions being imposed by the Governments vary with regions and nations. Furthermore, humankind has yet not achieved 100 per cent vaccination and certain areas still lack herd immunity. The scientific community can neither stop the virus from mutating nor can immediately mass-produce vaccines, to counter the mutating virus variants. All these facets have reduced the throughput of passengers in the aviation sector. Moreover, to cut costs, the aviation sector had retrenched its trained staff, reduced the aircraft inventory where possible, to avoid fixed costs.

Now, with an appreciable vaccination status and the opening up of routine trade and commerce, the airlines are also gearing up to reach the pre-2019 levels of passenger haulage. Some experts have predicted that a full recovery of the aviation sector will take place by 2024. The year 2023, is likely to see a surge and a near normalisation of domestic passenger traffic. It will be followed by international travel passenger’s recovery, by the year 2024.

All airlines may have to start with providing suitably redesigned itineraries, recruitment policies and retraining of the retrenched or new staff. They have to improve or modify their operational strategies, marketing plans, redesign their financial management practices followed by re-tweaking their Human Resource (HR) policies to take to the skies. Simultaneously, the airlines have to offer new marketing schemes, adapt their operational plans to offer flight services to attract the few passengers, who are willing to travel now, as the demand picks up. Of course in economics parlance demand means willingness and ability to pay. So, the air travel consuming industry has to now create air travel financing outlays from their corpus after a two year old slumber.

In addition, certain adaptations have to take place on the airside and the cityside of the aviation sector. The unpredictability of the Governmental regulations that follow, the waxing and waning of the infection by the virus; force the aviation companies to redesign their policies on the above-mentioned facets quite regularly.

REALITY CHECK

All airlines are yearning to fly back to profitability. However, they need to introspect realities based upon where they were heading before the pandemic and the current realities which the virulence of the virus left behind, amidst us.

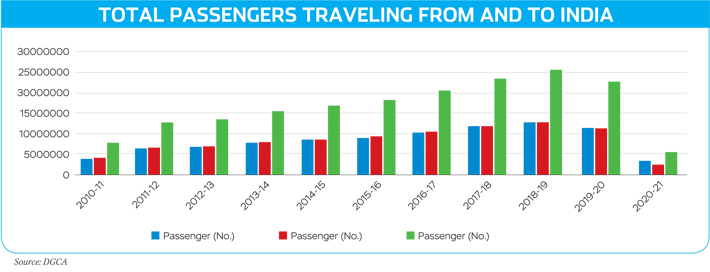

The underneath graph produced from the data obtained from the repository of DGCA shows that overseas travel was growing steadily from 2010 to 2018. It peaked in the financial year 2018-19 when more than 25 million passengers enjoyed air travel to and from India.

During these challenging times, airlines have to pay emphasis on customer relationship management, finding innovative ways to woo customers

From the year 2019 onwards, the number of travelers decreased substantially. The real impact of the COVID-19 pandemic could not be fathomed that year, so the air traffic dip, was lesser. The impact of the full lockdown is evident in the figures for year 2020–21.

This gives a clear indication of the disastrous impact of the pandemic. Infact, it shows that we had reached even below the pre-2010 levels of India-associated overseas travel. Seeing this graph, we now clearly know where we are currently or were in the last financial year, whose flight data has been filed by aviation companies with DGCA now, and where we need to go henceforth. So old aviation strategies may not work now but, new ones need to be devised, launched, tested, tweaked and relaunched till we taste success.

So, it can be said that, there is no ‘one size fits all formula’, to lift the aviation sector to soaring heights but to take comprehensive steps on HR, Operational, Marketing and Financial Management aspects to become profitable.

HR ASPECTS

In the last few years most of the airlines had retrenched their non-essential staff. However, all airlines require technical and hospitality personnel to serve passengers in order to generate revenue. The airlines now have to recall or recruit fresh human resources, retrain them, sensitise them about the regulations to prevent the spread of COVID-19 viruses and to assure passengers of safe travel. This will also ensure that the airlines do not run foul with the health regulations promulgated by ICAO, DGCA and the Government of India.

The newly inducted staff has to be nurtured to work together as teams and achieve the unified goals of the airlines while serving the passengers. They have to absorb the nuances of anti-virus health and hygiene issues, handling stress, dealing with passengers who are symptomatic or asymptomatic as far as COVID-19 is concerned.

To provide safe travel, it is quite likely that, few large-bodied aircraft are going to be operated so that, social distancing is possible during the flight. This also reduces the number of aircraft needed to operate, while conserving cash. Consequently, the pilot and aircrews have to be sensitized about hygiene and sanitation so that, they hand over a safe cockpit when the next set of crew members takes over the aircraft for another itinerary.

OPERATIONS MANAGEMENT

Airlines avoid keeping idle inventory which, bleeds cash. Hence, they may have to lease out or lease in and even renegotiate the availability of aircraft. They may deploy wide-bodied aircraft to carry more passengers especially displaced, within the fuselage, in order to prevent the spread of the COVID-19 virus if the economic cum operational parameters demand so.

The newly rostered ground handling staff has to be trained on handling digitised ticketing, e check-in, sealing of luggage, handling of e-vaccination certificates and minimum customer contact to check the virus spread.

MARKETING MANAGEMENT

As the economy is cash strapped, the airlines will have to use data analytics to deploy logistics models/itineraries that carry maximum passengers within the promulgated Governmental regulations, while ensuring that the revenue per flight is maximised. This may include sharing of passengers between airlines on a profit distribution basis so that, the economies of scale of flights, can be optimised. It has to be kept in mind that, while the airlines share passengers to optimise costs, they need to go the extra mile so as to be able to retain the loyalty of their passengers. This is very important as the revenue lost due to the shifting loyalties of an existing passenger due to code sharing gets far more compounded when a considerable marketing and sales effort is spent, to acquire a new or replacement customer.

Airlines may have to re-design itineraries, operational strategies, marketing plans, financial management practices followed by re-tweaking their Human Resource (HR) policies to take to the skies

Where feasible, the airlines may utilise the surplus space inside the fuselage to carry revenue-generating cargo in the absence of human travelers. This requires implementing out-of-the-box solutions, like, removing seats from an aircraft. However, abhorable, may this idea sound, but cash generation to keep the airlines afloat may sweeten this bitter pill.

The airlines could offer heavy discounts to ensure cash sales of tickets. In the case of re-scheduled or missed flights, the airline should promptly refund the collected amount in cash, rather than offering a credit note to the passenger. This will help the airlines to retain the loyalty of the customer. Any attempt by the airline to lock in the ticket fees of the passenger will lead to ill feelings and the passenger may switch his loyalties to another airline. This will definitely impact the goodwill of the airline vis-a-vis ‘that’ passenger.

In order to reduce the passenger clutter at the airports, the airlines may reschedule their flights to ensure that a minimum passenger to passenger contact takes place within the airport. The airlines can also offer paid, pick up and drop facilities to the passengers to avoid their movement through public transport. This will minimise the chances of getting the airline embroiled in any pandemic related controversy and the resultant backlash. This is so because such backlashes will take a near, real time toll, on the cash flows and this will continue to simmer, till the public memory fades or the regulatory levies last.

The regional connectivity scheme expects that the initial recovery will take place on the main trunk routes. Once, these itineraries become fruitful then, the possibility of the hub and spoke model becoming profitable will follow suit. Therefore, to conserve cash, the airlines may have to reduce their dependence on the hub and spoke model for the pooling of passengers. Consequently, to enhance ticket sales, the most evident option lies in offering customised flight schedules and itineraries that can carry the maximum number of passengers in one haul to remain profitable. During these challenging times, airlines have to pay emphasis on customer relationship management, finding innovative ways to woo customers, maybe reducing the number of agents who take a commission to bring passengers to the airlines.

FINANCIAL MANAGEMENT

Cash is the bloodline of any operation. Airlines may find it prudent to renegotiate their lease, re-schedule the Maintenance Repair and Overhaul (MRO) requirements, restructure their debt, infuse fresh capital to operate the airline and maybe eliminate some of the non-operating aircraft to remain successful.

It will be interesting to note that during the year 2019, a total of 9.2 million passengers traveled by air globally. Out of these, 54 per cent traveled on domestic and 46 per cent traveled on international flights. These figures in the year 2020 changed to 72 per cent and 28 per cent respectively for domestic and international travel. Interestingly, the year 2021 saw 6.6 billion people traveling by air, which constituted about 64 per cent and 36 per cent of domestic and international travelers.

Airlines may find it prudent to renegotiate their lease, re-schedule the Maintenance Repair and Overhaul (MRO) requirements, restructure their debt, and maybe eliminate some of the non-operating aircraft

Notwithstanding the above, the positive growth and maximum revenues are coming from domestic travelers. However, once international flights fully open up, then, higher revenues will be earned.

Another revenue-generating option includes offering differential pricing to wean waitlisted passengers from the railways. It would require an investment in software but it will enhance the revenues of the airlines. This aspect may need concordance at the highest level. Furthermore, the tourism industry too needs to propagate and advertise their events. This will increase the demand for air travel.

The airlines would have to prevail upon the States to offer aid, to remain afloat. Airlines can improve their credit ratings and goodwill to raise cash through bonds to stay afloat. They may have to stretch their resources to generate enough cash flows. If need be, new ownership with fresh capital on a profit-sharing basis may have to be on boarded to acquire liquidity.

Usually, all companies spend about seven per cent of their gross collections on advertisements. Now, the airlines can utilise a greater proportion of this amount to improve their IT automation infrastructure, to attract more revenue in the form of ticket sales or cargo haulage.

This is the first-time humankind has faced such a catastrophic disruption in its modern existence. This unexpected black swan catastrophe has to be overcome by using unorthodox and new out of the box, almost revolutionary ideas by the aviation companies to remain profitable and to weather out this storm.