The Cost of Airline Operations

Time and again, airline failures can be traced to one key item which is the ‘Cost of Operations’ that spiraled out of control

Herb Kelleher, the legendary CEO of Southwest Airlines, once joked stating, “If the Wright Brothers were alive today, Wilbur would have to fire Orville to reduce costs.” This statement is indicative of just how challenging and frustrating it is to consistently attack the cost base of airline operations. Yet it is an action that cannot be overlooked. Time and again, airline failures can be traced to one key item which is the ‘Cost of Operations’ that spiraled out of control.

The cost of airline operations is particularly challenging because of the nature of the fixed and variable costs. The fixed costs are fairly high whether it is aircraft, maintenance, renting airport space, and IT systems. The way to manage this is to amortise this over a large base, but not all airlines have this as a part of their strategic plan. As for variable cost, the nature of the costs is such that the airline always carries risk. Flying from one-point to another, crewing costs are constant, there are minimum fuel requirements, landing and parking costs are based on the Maximum Take-Off Weights (MTOWs) and costs of disruption are borne by the airline. Thus for airlines, there is a rush to attack each cost item no matter how miniscule it may be. Consider the following:

- American Airlines saved over $40,000 by removing just one olive from its meal tray – impacting both food costs and weight reduction.

- United Airlines saved hundreds of thousands of dollars by removing towels on short flights.

- Northwest Airlines started to slice its limes in to 16 pieces instead 10, thus reducing the number of limes carried on a flight and saving over $5,00,000 per year.

- British Airways started printing the in-flight magazine on thinner paper and reduced the weight by 70 grams per piece. Savings were $3,00,000 per year.

- JetBlue moved from paper-based manuals to digital manuals enabling weight reduction and consequently lower fuel burn.

- IndiGo used operational procedures that included singleengine taxiing, leveraging winds aloft and using direct routings for shorter flight paths that enabled cost reductions.

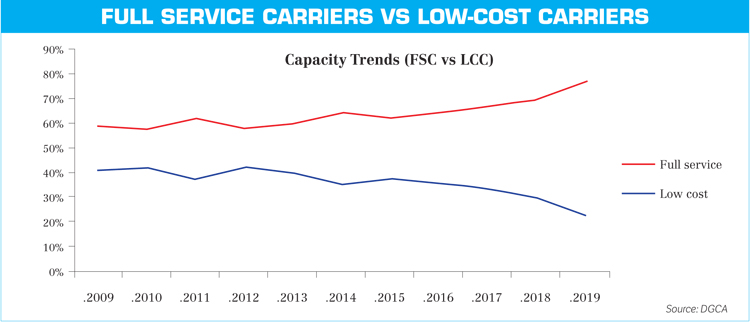

For airline operations, these measures matter more than ever because increasingly, the air passenger is gravitating towards price. And increasingly, travel is becoming commoditised both via pricing and policy. Terms such as “rail-air parity” that were unheard of even five years ago, are a reality. Affordability and access is a core focus for government policy. For India, Low Cost Carriers such as IndiGo, SpiceJet and AirAsia India have been quick to capitalise on this and have pumped significant capacity into the market as evidenced from Fig. 1 below.

COSTS OF AIRLINE OPERAT IONS: CRITICAL TO SUCCESS

To understand why the cost of operations plays a critical role in the success of an airline one does not need to look far. Indeed, when examined in terms of one of the most widely used frameworks - the Porters-5 Forces Framework, the answer is very clear. The framework deals with five forces namely the bargaining power of suppliers; the bargaining power of buyers; barriers to entry; the threat of substitutes and competitive rivalry within the industry. Ideally if the forces are weak, the attractiveness is high. Alas, for the airline business, this is just not the case.

The airline business when examined using this framework, clearly indicates why it is not attractive. Competition in the airline industry is fierce and the threat of alternative modes of travel including road and rail is high and barriers to entry are low. It is fairly easy to set up an airline as suppliers are limited thereby giving them strong power and the bargaining power of passengers is high. In such a scenario, it is the lowest price offering that tends to win and more often than not, this is driven by managing the cost of airline operations.

For Indian operators, the largest operating cost item is fuel followed by maintenance and airport charges. On the non-operating costs, the largest cost item is the capital cost of aircraft followed by financing costs and costs of setup. Each item has to be closely examined and catered for. This requires a tremendous amount of discipline and it is easy to veer off course. But as they say in the airline business, a linear cost base is a recipe for disaster.

Over the years, many airlines have failed and inevitably, the cause can be traced back to a failure to control the cost base. Whether it was Kingfisher Airlines, Paramount Airways, Jet Airways or Air India, the one common theme is the inflated cost base. The clearest indication of this is in the Cost per Available Seat Kilometre (CASK). More competitive the CASK, more competitive the fares. Add to it significant capacity, domination in metro-cities which still accounts for majority of the traffic and a wide network and success follows.

COST REDUCTION MEASURES BY AIRLINES

| Process | Cost Reduction Measures |

|---|---|

| Booking | Goal of shifting majority bookings via online engine(s) |

| Boarding pass | Self printed boarding pass |

| Check-in | Self-tagging of bags |

| Boarding Gate | Automated boarding pass scan |

| In-flight | Pre-booked meals |

MANAGEMENT OF FUEL, MAINTENANCE AND FX

The largest operational expense item for any airline is Aviation Turbine Fuel (ATF). For Indian carriers, ATF constitutes 35 to 40 per cent of an airline cost base. Unfortunately, the pricing of ATF in India is based on import parity rather than on the basis of actual cost including refining and marketing. The industry has long demanded that ATF taxation be rationalised but no such move has yet been initiated. Despite the introduction of GST in 2017, ATF continues to be out of its purview, leading to incredibly thin margins of two to four per cent for the industry.

After ATF, the second largest expense item for airlines is the Maintenance, Repair and Overhaul (MRO) of aircraft. Taxation on MRO in India remains very high. With an 18 per cent GST, Indian MRO companies have to compete with overseas players that only pay five per cent - that too at cost price. Consequently, most airlines contract their maintenance overseas. Even so, the MRO has to be provisioned for and negotiated adequately. Flying empty aircraft to cities outside India, if planned well, can be done in an integrative manner with network planning. The goal is simply to not have empty aircraft being ferried. Contractual provisions can further limit down-time of each aircraft ensuring higher asset availability.

COMPETITION IN THE AIRLINE INDUSTRY IS FIERCE AND THE THREAT OF ALTERNATIVE MODES OF TRAVEL INCLUDING ROAD AND RAIL, IS HIGH AND BARRIERS TO ENTRY ARE LOW

Finally, there is the currency challenge of Foreign Exchange (FX). The challenge for Indian carriers is that aircraft lease payments and maintenance payments are dollar denominated. Additionally, the revenue mix for airlines is such that most of the revenue is earned in rupees. Thus, in the event of a market slowdown or weakening rupee, the airlines have an additional cash outflow. Hedging is an option, but it requires specific expertise and is fairly risky. Overall, most cost control initiatives can be traced back to fuel, maintenance and FX. As long as these are kept under control, the airline can count on being competitive.

MEASURES FOR COST REDUCTION

Airlines continually focus on operational measures to reduce cost and majority of these are centered on the processes and materials required for a successful flight. For instance, servicing an aircraft requires several different forms of ground transportation ranging from loading baggage to uplifting fuel. On this front, fuel efficient and battery operated ground transportation is a focus area, but the capital cost has to be measured against the operational cost. Airlines are also focusing on how much weight they put on to aircraft. For instance, most airlines have replaced plastic cups with paper cups. The uplift of food is now closely monitored with a focus on reducing waste as well, not all seats have in-flight magazines, the weight of in-flight magazines is addressed and ground water recharging and water conservation policies are being implemented.

While in the air, the key focus is on reducted fuel consumption and conservation. From more fuel efficient engines to flying procedures – marginal gains are to be made everywhere. And for airlines, better fuel planning carries a dual advantage because lesser fuel consumption is also a critical profit driver. Initiatives here range from reduction in contingency fuel to new methods of dispatching aircraft. Other more technical initiatives include the use of variable cost indices which looks at the time to fly city pairs as a ratio to the cost of flying, shorter direct routings and continuous descents for landing. More accurate zero-fuel weights, optimising the centre of gravity and leveraging weather patterns are other initiatives that are being undertaken.

COST FOCUS AS A PHILOSOPHY

The market often tends to confuse cost-focus as a management initiative rather than a core philosophy. As such, it is misleading because an airline can offer a full-service product while managing its cost base. That said, the focus can be woven into management goals. It can often lead to very different decisions pertaining to various functions from network to fleet to even IT systems. As an example, airlines can target a debt to EBITAR range of 1.5X to 2.5X. What this means is that the cost of new initiatives must be such that the debt levels are covered within the range at all times and this inherently drives cost discipline. Without such a target, there could be an inordinate focus on cost of operations while other costs may be overlooked. This too, is a recipe for disaster.

WHAT THE FUTURE HOLDS

As India’s airlines expand and compete globally, their focus on costs will be ever more critical. The aim would be to move towards surety, sustainability and success. And this focus cannot come at the expense of quality. In fact, quality must go up as costs go down. And this is the challenge presented to airlines the world over.

The author has held a variety of appointments in the domain of civil aviation, most recently as the Head of Strategy & Planning in Go Airlines (India). Previously, he was with CAPA where he led the Advisory and Research teams. He joined CAPA after a working through a merger and restructuring at a legacy US carrier. Having lived and worked across four continents, he is an alumnus of the University of New South Wales and the London Business School. He is also a certified pilot with Instrument Rating.