A Bright Future

With economies opening up fast and smaller towns and cities getting networked with metros, the future of regional aviation is promising

Geographically and demographically large countries such as China, India, Brazil and the US will witness exponential growth in regional aviation. Meanwhile, airlines in smaller countries in the Middle East and South East Asia will be looking at expanding into the region with international operations as a sustainable business model. The future of regional aviation hinges primarily on geographical distances within a country and in some cases beyond national boundaries but within the region.

For instance, in India, there is a move towards pan-India air connectivity which is possible through a mix of air transportation modes, regional being an important one. Realising this and expecting increased economic activity in Tier-II and III cities, the Ministry of Civil Aviation (MoCA) has drafted a policy on ‘Regional and Remote Area Air Connectivity’ consequently enhancing the movement of people and goods. The MoCA has cleared over a dozen applications for setting up regional airlines. Buoyed by the enthusiasm and development prospects put forth by the new government, a few of these are expected to take-off in the near future.

Having commenced regional operations, Air Costa has set the ball rolling and announced major expansion plans with the proposed induction of 50 Embraer E-Jets in the next two years; a signal for other players keen on entering this segment that there are opportunities to be tapped in the regional market.

Major Airliners Eyeing Regional Aviation

Major players such as IndiGo and SpiceJet have evinced interest in regional routes. Having ordered 15 Bombardier Q-400 80-seater turboprop aircraft, SpiceJet is eyeing the South Indian market to make a regional foray. However, these plans have been in the pipeline for quite a while. SpiceJet hopes to revive them with the new government’s promises on aviation-friendly initiatives. In fact, the previous Minister for Civil Aviation, Ajit Singh, had indicated that pan-India air connectivity would get priority. Accordingly, the Airports Authority of India (AAI) has plans on developing 50 low-cost airports in remote and interior areas. The government envisages an investment of $12.1 billion in the airports sector during the Twelfth Five Year Plan period (2012-17), of which $9.3 billion is expected to come from the private sector for the construction of new airports, expansion and modernisation of existing airports as well as development of low-cost ones.

As per the policy announced by the previous government, every operator has to provide a minimum level of air transport services to designated remote and strategic locations as well as the areas stipulated in the new regional aviation policy. It remains to be seen how this proposal would be optimally tweaked by the new dispensation. And airlines on their part will have to get the ‘size’ right to operate on these routes – they cannot fly single-aisle large aircraft nor can they think of small aircraft with fewer than 50 seats. For optimisation on the regional routes, aircraft in the 70-110 seat configuration would appear to be a viable proposition.

Accordingly, the AAI has suggested that the Route Disbursal Guidelines (RDG) be amended as it was presently loaded in favour of 17 international airports as compared to 55 domestic airports which flew fewer than ten per cent of the passenger traffic.

Regional Airport Development

The AAI has identified the following airports for concessions and development: Cuddapah (Andhra Pradesh); Akola, Gondia, Jalgaon, Nanded, Nashik and Sholapur (Maharashtra); Keshod, Bhavnagar, Rajkot and Porbandar (Gujarat); Cooch Behar and Hoogli (West Bengal); Kota (Rajasthan); Shimla, Dharamshala and Bhuntar/Kullu (Himachal Pradesh); Bilaspur (Chhattisgarh); Jabalpur (Madhya Pradesh); Deoghar (Jharkhand); Gaya (Bihar); Jharsuguda (Odisha); Tuticorin (Tamil Nadu); Ludhiana (Punjab); Mysore, Hubli and Belgaum (Karnataka) and Puducherry.

The regional airports included are Sagar (Madhya Pradesh); Bareilly and Meerut (Uttar Pradesh); Karnal (Haryana); Diu and Jamshedpur. The regional airports (civil enclaves) are Gwalior (Madhya Pradesh); Pathankot and Bhatinda (Punjab); Bikaner and Jaisalmer (Rajasthan); Jamnagar (Gujarat) and Kanpur and Allahabad (Uttar Pradesh).

To boost regional operations, airlines will get the concessions for an initial period of three years if they operate on regional routes. The concessions are basically exemptions from charges on landing and parking, Route Navigation Facilities Charges, Passenger Service Fee, fuel through put and any others levied by AAI. Besides, they will also get to manage ground handling at these airports themselves. The policy also has suggested establishing an air connectivity fund as a long-term measure to provide the necessary financial support to promote regional aviation. The size of the fund, tenure and the institutionalised mechanism to administer the fund is to be separately notified by the government.

With such anticipated development, a report by global consultants KPMG and the Federation of Indian Chambers of Commerce and Industry has projected that by 2030 India’s civil aviation sector could be the best worldwide. The industry has ushered in a new wave of expansion driven by low-cost carriers, modern airports, foreign direct investments in domestic airlines and regional connectivity. The report notes that the next generation of aviation growth in India will be triggered by regional airports. At present, there are around 450 used, unused and abandoned airports and airstrips all over the country. Many Indian states, especially in eastern India, have begun taking proactive measures to promote air connectivity.

Chinese Expansion

A similar story is being scripted in China where the rapidly expanding regional aviation market is attracting the attention of global aircraft manufacturers, as it is expected to grow by leaps and bounds in the next few years with the government moving to tap its potential. Embraer has a strong presence in China and other air frame manufacturers are making forays. Besides, China has its own plans to manufacture the ARJ21.

The Civil Aviation Authority of China is planning to build 32 new airports, rebuild and expand 24 others, as well as relocate nine more in West China in the Twelfth Five Year Plan period.

Guo Qing, Vice-President, Marketing, Embraer China, said, “Embraer is very optimistic about the future development of China’s domestic regional aviation market, especially in the country’s underdeveloped regions.” Embraer, the world’s fourth-largest aircraft maker, has signed an agreement with China Development Bank Leasing and China Southern Airlines (CSA) to sell ten E-190 jet planes to CSA, China’s largest airline by fleet size, which will be put into service on routes in the country’s north-western Xinjiang Uygur autonomous region.

Late last year, Embraer said in a market forecast that China’s domestic carriers would need 950 30- to 120-seat regional jets in the next 20 years, accounting for 14 per cent of the global demand during the period, the highest after Europe.

Brazil Investing in Regional Aviation

Brazil is also on a growth trajectory; aviation is going to witness massive changes in the near future. According to Johann Frank, Managing Director, Airport Consulting Vienna, there is move to go in for public-private partnership for development of 270 regional airports. As a result, over the next five years, $2.2 billion will be invested on improving the infrastructure of Brazil’s regional airports and a further $1 billion on incentives to encourage airlines to fly to the selected airports.

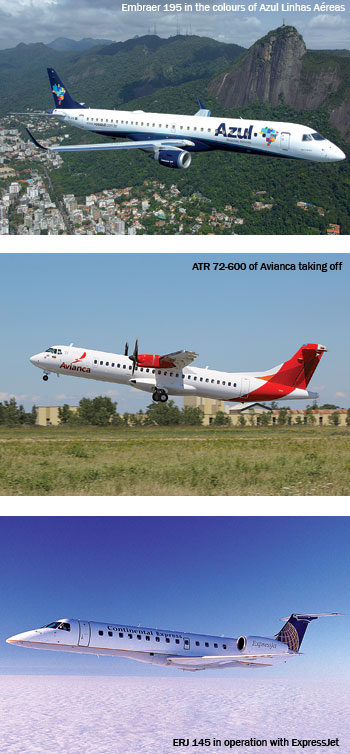

Airlines such as Tam, Avianca and Azul have already been responsive to the regionalisation of Brazil’s air transportation. Although Brazil has eight domestic and 30 international airlines, only 14 airports have a home base carrier attesting to a high concentration of flight activity in a few spots notably located within Brazil’s economic and financial heart in its south-eastern region.

There is certainly room for expansion because as on date only 120 of Brazil’s 5,565 cities have air connections. In the next decade or two, about 1,100 Brazilian airports will become available to the private sector. They will include regional airports, privately-owned airstrips and greenfield projects. Such diversity will inevitably require many different business models, Johann Frank mentions in a report.

Regional Airlines in Europe

European regional airlines serve the intra-continental sector in Europe connecting cities to major airports and to other cities, negating the need for transfers. For example, BA CityFlyer a regional subsidiary of British Airways, uses the basic Chatham Dockyard Union Flag livery of its parent company and flies between domestic and European cities. In a slightly different category, ExpressJet Airlines, another regional carrier is independently owned and managed. 205 of its planes in the aircraft fleet operate in the marketing brand of Continental Airline Inc., Continental Express. In these roles, all of the preceding airlines are operated primarily to bring passengers to the major hubs, where they will connect for longer distance flights on the national airlines.

In Europe, regional aviation is playing a key role in connecting smaller nations. Recently, Etihad Airways, the national carrier of the United Arab Emirates, announced a ‘step-change in global aviation’ with the launch of its first branded regional operation, after taking a 33.3 per cent stake in the Swiss carrier Darwin Airline. Darwin Airline will rebrand its operations as Etihad Regional and align its network to connect passengers from secondary European markets onto the main networks of Etihad Airways and its equity alliance partners.

Europe’s regional aviation sector is slowly growing, according to Simon McNamara, Director General of the European Regions Airline Association. Analysis of data for 2013 shows that the last quarter of the year marked positive changes for the sector in terms of passenger numbers, aircraft movements and numbers of routes. “The last two years have been extremely testing for our members so to see a modest return to growth at the end of 2013 is encouraging.”

The huge economic and social importance of regional airports to local communities and entire regions imply that they are assets that need protection, according to Thomas Langeland, Head, ACI Europe’s Regional Airports Forum, a universal statement.