Regional Connectivity Driving Growth and Development

The UDAN scheme has been a game-changer for India’s aviation industry, democratising air travel, stimulating economic development, and fostering regional connectivity becoming a cornerstone of India’s aviation strategy

India’s regional aviation market is on the cusp of a significant transformation, experiencing rapid growth fueled by the government’s push for improved connectivity and the rising demand for air travel in smaller cities. With new airlines entering the fray and established carriers expanding their regional networks, the sector is set to play a crucial role in enhancing accessibility and driving economic development across the country. This expansion underscores the importance of regional air travel in bridging the gap between major hubs and remote areas, contributing to the overall growth of India’s aviation industry and the country’s economy.

India’s regional aviation sector is expecting shifts in the nation’s aviation trajectory with new additions of Alhind Airline following Air Kerala from the same region. Kerala-based travel services operator, Alhind Group, recently received initial approval from India’s Civil Aviation Ministry to launch its own airline, Alhind Air. Aiming to begin operations by the end of this year, the group is now focused on obtaining the crucial Air Operator Certificate (AOC) from the Directorate General of Civil Aviation (DGCA) to finalise its entry into the aviation sector. This move signifies Alhind Group’s strategic expansion into the competitive aviation market, driven by the growing demand for air travel in the region. Alhind Air plans to initially operate regional routes in southern India, connecting Cochin with Bengaluru, Thiruvananthapuram, and Chennai using a fleet of three ATR-72 aircraft, known for their efficiency on short-haul flights. The airline has ambitious plans to expand its operations nationwide, eventually incorporating Airbus A320 aircraft to serve longer domestic routes and, within two years, launching international flights after increasing its fleet size to over 20 planes.

The airline’s establishment is backed by the well-established Alhind Tours & Travels Pvt Ltd, part of the Alhind Group, a major player in the travel and tourism industry both in India and internationally. With over 130 offices worldwide, a reported turnover exceeding ₹20,000 crore, and a broad range of services including air ticketing, holiday packages, and visa facilitation, the group has carved out a significant presence in the industry. Alhind Group’s entry into the airline industry is largely motivated by the high demand for air travel between Kerala and Gulf countries, a market Alhind Group is well-positioned to serve, given its extensive experience and robust presence in the region. The company is set to invest between ₹200 crore to ₹500 crore in this new venture, underscoring its commitment to becoming a significant player in India’s domestic aviation sector.

The new regional airline Air Kerala is ready to make an entry with an aim to mark a milestone in Kerala’s aviation history. The venture, backed by Dubai-based Malayali entrepreneurs Afi Ahmed and Ayub Kallada, received its no-objection certificate (NOC) from the Ministry of Civil Aviation (MoCA) in July, paving the way for its official launch in 2025. As the first regional airline originating from Kerala at the time, Air Kerala’s entry signified not just a business opportunity but a strategic move to address the unique travel needs of the state and its large expatriate community.

Air Kerala, owned by Zett Fly Aviation Private Limited, plans to base its operations in Kochi, leveraging the city’s existing robust air traffic infrastructure. The airline’s initial fleet will also consist of three ATR 72-600 aircraft, focusing on domestic routes that connect Tier II and Tier III cities with major metros in South India. These aircraft are particularly well-suited for regional operations due to their efficiency on shorter routes and lower operating costs. The company’s ambitious roadmap includes expanding its fleet to 20 aircraft and exploring international routes, with Dubai as a prime target, owing to the significant Malayali population residing in the Gulf region. The airline aims to make air travel more affordable and accessible, particularly during peak travel seasons when demand surges, and ticket prices can become prohibitive. Kerala, with its four major airports—Kannur, Kochi, Kozhikode, and Thiruvananthapuram—already has a well-established aviation network. However, Air Kerala’s strategic focus on serving both domestic and international markets uniquely positions it to tap into the high demand for connectivity, especially between Kerala and the Gulf.

GROWING REGIONAL CONNECTIVITY

These new airlines are making an entry into a rapidly evolving aviation landscape. These airlines’ strategic focus on serving both domestic and international markets, combined with the broader expansion of regional airlines in India, underscores the growing importance of regional aviation in the country’s economic and social development.

The entry of Air Kerala and Alhind Air are a latest in a series of developments that highlight the growing importance of regional aviation in India. Earlier this year, FLY91, another regional airline, began its commercial operations, marking a significant expansion in the country’s regional connectivity. Similarly, Star Air, another regional airline, is focusing on expanding its network by adding more routes and aircraft. FlyBig, too, continues to increase its route network, further strengthening India’s regional connectivity. A major player in this space is Alliance Air, a state-owned carrier and a key operator under the government’s UDAN (Ude Desh ka Aam Naagrik) scheme. Earlier this year, the Union civil aviation ministry awarded 28 non-operational routes to Alliance Air under the UDAN 5.3 short-bidding round.

India’s regional aviation market is undergoing rapid growth, driven by government initiatives to improve connectivity and rising demand for air travel in smaller cities

The expansion of regional aviation in India, driven by the UDAN scheme, is more than just a boost to the aviation sector. It represents a significant opportunity for socio-economic development across the country. Improved access to air travel facilitates trade, investment, and the movement of people and goods, driving infrastructure development, tourism promotion, and the establishment of new markets. By connecting more routes and adding supportive infrastructure like airports has significantly increased tourist footfall and made it easier for businesses to operate in remote regions, further boosting local economies, and fostering local entrepreneurship and investment.

Moreover, the focus on regional connectivity aligns with the government’s broader goals of promoting local industries and encouraging balanced regional development. The ease of transportation and increased accessibility have the potential to enhance local tourism, expand economic opportunities, and contribute to the overall growth of the national economy.

DEMOCRATISING AIR TRAVEL

In a transformative initiative aimed at democratising air travel and enhancing regional connectivity, the Indian government launched the Regional Connectivity Scheme (RCS) in 2017. Popularly known as UDAN (Ude Desh ka Aam Naagrik), this programme seeks to make air travel affordable and accessible to the common citizen while linking underserved and unserved airports across the country. Over these last couple of years, UDAN has become a cornerstone of India’s aviation landscape, driving economic growth, promoting tourism, and significantly boosting regional connectivity.

The UDAN scheme was designed with the primary objective of bridging the gap between metropolitan cities and tier-2 and tier-3 towns. By operationalising flights on these routes, the government aims to bring smaller cities closer to major economic centers, facilitating the movement of people, goods, and services, and fostering trade and investment opportunities.

UDAN is a demand-driven scheme, wherein airline operators assess the feasibility of operation on a particular route and submit bids under the scheme from time to time. An airport which is included in the awarded routes of UDAN and requires upgradation/development for commencement of UDAN operations, is developed under the ‘Revival of unserved and underserved airports’ scheme. Under the scheme, the airfare for a one-hour journey by a fixed-wing aircraft or a half-hour journey by helicopter over approximately 500 kilometers is capped at ₹2,500, which is significantly lower.

To operationalise routes under UDAN, aviation companies bid for air routes, with the contract being awarded to the company that requests the lowest subsidy. The airline is then required to reserve a portion of the seats—either half of them, a minimum of nine seats, or a maximum of 40 seats—at the capped fare.

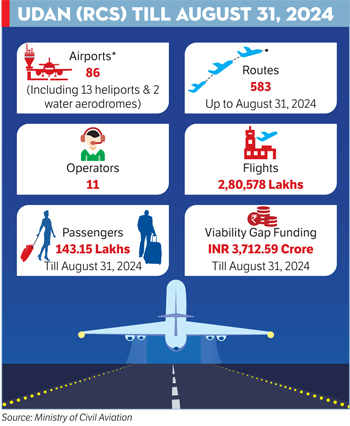

On the basis of five rounds of biddings, 76 airports, including two water aerodromes and nine Helipads in different regions of the country, had been developed and operationalised by RCS flights at the beginning of this year. The RCS scheme also mandates Regional Connectivity Fund allocation to regions in a manner that promotes balanced growth / regional connectivity in different parts of the country.

As of July 8, 2024, a total of 579 routes have been operationalised under the scheme across various phases. The routes include more than 53 tourism routes and over 48 helicopter routes connecting hilly regions of the nation. According to the data shared by the Ministry, more than 133.86 lakh passengers have benefited from the UDAN flights and over 2.56 lakh flights have operated under the scheme. The UDAN scheme has also encouraged procurement of different types of aircraft in the country. Presently, 3 seater Tecnam, 9 seater Cessna 208B, 19 seater Twin Otter, 50 seater Embraer 145, 42/72/78 seater ATR and Q-400 as well as bigger aircraft like 189 seater Airbus 320/321 and B737 are in operation for UDAN flights. This surge in demand has driven a substantial increase in the requirement for new aircraft, ranging from helicopters and seaplanes to larger jets. 13 Airlines have commenced operations under UDAN, including Air Taxi, IndiaOne, Star Air, FlyBig and Fly91. While many of these new airlines are looking at an upward trajectory, some airlines have also shut down due to high maintenance costs, lack of infrastructure like MRO facilities and skilled workforce like trained pilots, etc. Nevertheless, the scheme has played a pivotal role in promoting tourism by connecting key destinations such as Khajuraho, Deoghar, Amritsar, and Kishangarh (Ajmer), thereby stimulating local economic growth and supporting the hospitality industry.

The success of UDAN is evident in the development and modernisation of regional airports. The scheme has operationalised over 75 airports. Cities like Agra, Bikaner, and Kanpur, previously underserved, now enjoy enhanced air connectivity, which has fostered local tourism and economic growth. For example, Jharsuguda Airport in Odisha, developed under UDAN, has become a gateway for the region’s industrial belt, significantly boosting local economic activity.

Enhanced connectivity through UDAN has opened up previously inaccessible destinations, particularly in regions like the Northeast. This has led to a surge in tourism, contributing to local economies and creating jobs. For instance, Himachal Pradesh saw a 20 per cent increase in tourist arrivals following the introduction of UDAN flights to Shimla and Kullu, significantly benefiting the state’s economy. By making air travel more affordable, the scheme has democratised aviation, allowing more people from diverse socio-economic backgrounds to fly, further driving inclusive growth.

FUTURE PROSPECTS AND CHALLENGES

Despite its successes, UDAN faces several challenges. The sustainability of subsidies is a significant concern, as is the need for continued investment in airport infrastructure, particularly in remote areas. Operational challenges such as inadequate infrastructure and skilled manpower at smaller airports also pose difficulties for airlines. Additionally, increased air traffic raises environmental concerns, highlighting the need for sustainable aviation practices. While UDAN has provided airlines with opportunities to expand their networks and tap into new markets, it also presents challenges, particularly in operating less profitable routes. The scheme’s Viability Gap Funding (VGF) mechanism helps airlines maintain operational viability on these routes by subsidising a portion of the airfares. As of August 2, 2024, Rs.3,587 crores have been disbursed to the Selected Airline Operators towards VGF as per the provisions of the Scheme. However, the long-term sustainability of these routes will depend on airlines gradually reducing reliance on subsidies as market demand increases. Looking ahead, the future of regional aviation under UDAN is promising. The government aims to phase out subsidies as routes become self-sustaining and continues to enhance infrastructure and operational capabilities at regional airports. With continued investment and innovation, regional airlines are poised to play an even greater role in India’s economic growth. This enhanced connectivity is driving economic growth by boosting trade, commerce, and tourism in previously underserved regions. The development and modernisation of regional airports are creating jobs and stimulating local economies, positioning regional aviation as a key driver of India’s overall economic development.