An Untapped Potential

The under utilised capabilities of helicopters in India highlights the need for Government and Ministry of Civil Aviation assistance to navigate various challenges and leverage the abundant opportunities available

Indian aviation is one of the fastest growing aviation markets globally having third largest market in terms of domestic capacity following US and China. In 2023, a whooping 133 new planes were inducted by different commercial airlines recording a 51 per cent rise over 2022. The post-COVID Indian civil aviation recovery market is soaring. In comparison, a rather gloomy picture greets the eye when we ponder over the helicopter industry in India. A little deep study into the helicopter market, leaves one with a lot of debatable questions like what exactly is lacking, why is India’s helicopter market still untapped? Why does a country with a population of 140 crores and counting has a mere 250 helicopters with just 1,900 heliports? Such figures make one wonder – Why is the helicopter industry receiving stepmotherly treatment at the hands of the Ministry?

One of the key reasons for this stagnation as per Airbus is perception of helicopters in the minds of Indian population at large that ‘helicopters are only for rich.’ Due to this mental image the citizen has largely remained disconnected from its benefits and Governments have baulked from backing an idea that does not resonate with the masses. Echoing these views, Amit Dutta, Managing Director, Hunch Mobility, feels that helicopters are often perceived as a luxury reserved for VVIPs, celebrities, and politicians, overshadowing their fundamental role in enhancing accessibility to remote destinations and providing unparalleled efficiency. This perception that helicopters are exclusively for the elite has contributed to their underutilisation in addressing broader transportation needs. Along with perception, there is a lack of awareness regarding the efficiency and convenience of helicopters especially regarding the accessibility in remote locations adds Dutta. “This limited fleet is further compounded by underutilisation of helipads and burdened with regulatory hurdles.”

Globally, employment of helicopters in law enforcement and emergency medical services enhances their operational viability. In India, these services are practically non-existent. “Poor consumer demand resulting in limited growth is a relevant challenge while alienation to technology absorption impeding this demand is unexplainable,” says Captain Peeyush Kumar of HeliGo Charter services. Countries leading the ‘pack’ of helicopter operations like Norway, Switzerland and Germany, have embraced helicopter-based transfers under Performance Based Navigation (PBN) concept which is a helicopter-specific operational alternative developed by ICAO for all weather, day/night operations from heliports. “Indian helicopter sector on the other hand is content with its legacy ‘sunrise-sunset, good-weather-only’ window from heliports. It is only unfortunate that the dismal safety record of helicopter accidents possible to be offset through aforesaid PBN based operations remain estranged in India,” Captain Kumar adds. Additionally, poor safety record, non-reliability of planned schedule owing to traditional heliport operations are the primary tie-downs of Indian helicopter industry.

WHY IS THE HELICOPTER SECTOR STILL LAGGING BEHIND?

India currently lacks an operator with adequate size to drive growth and expand in virgin areas, says Vishok Mansingh, Chief Executive, Vman. The new and existing operators need access to funding and leasing of helicopters in India. “Vman is focusing on leasing helicopters to those who are not able to access assets from international leasing companies due to weak balance sheets or inadequate collateral,” comments Mansingh. According to him, the current VGF under RCS UDAN is inadequate with the current cost of the operation of the helicopter. This is holding the development of a new route under UDAN.

Meanwhile Vman has become the first private Indian lessor to sign a memorandum of understanding with Hindustan Aeronautics (HAL) to form a joint venture for leasing aircraft. As agreement was signed with Hindustan Aeronautics Limited to lease five light utility helicopters (LUH) with options for five more. The civil version of the LUH is expected to be rolled out in 2025.

Moreover, the ease of purchasing helicopters has historically presented a challenge. However, initiatives like GIFT City are now playing a pivotal role in streamlining the acquisition process, potentially opening up new avenues for the industry. Dutta claims that simplifying acquisition procedures will be crucial in unlocking the full potential of the helicopter industry in India. Lack of the management capability to handle complex operations like HEMS, URBAN mobility, and PBN operation are also critical factors dragging the helicopter industry behind.

POTENTIAL CORRECTIVE STEPS TO OVERCOME THE CHALLENGES

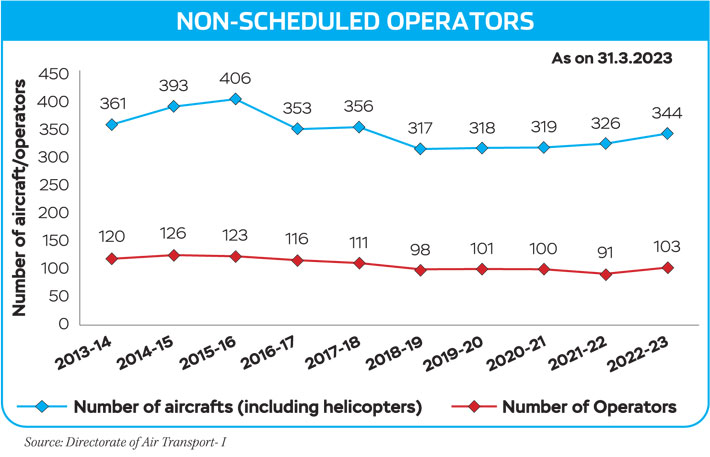

Of the 250 helicopters, about 181 are have the Non-scheduled Operator’s Permit (NSOP), 26 of them fall under the ambit of various state Governments like Maharashtra, Uttar Pradesh and more while the rest belong to privately-owned by individuals and corporates, as per the latest data by Ministry of Civil Aviation.

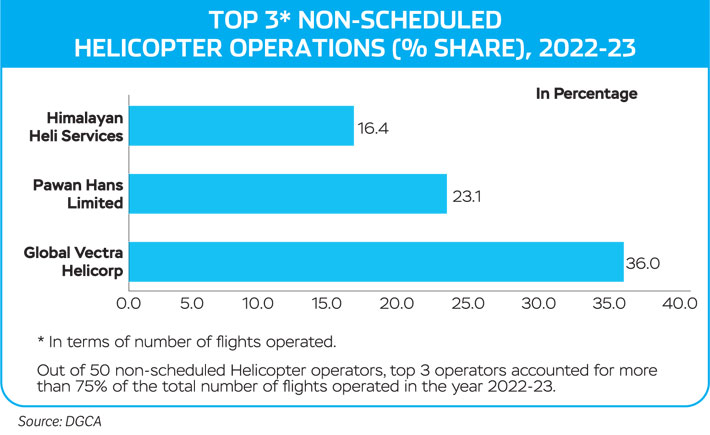

There is a vast gap in the fleet operator with Pawan Hans owning over 40 helicopters at one end of the spectrum while certain private operator owning just one helicopter. Only three operators have more than two-digit fleet out of 40 + operators while most of the operators have just a helicopter fleet ranging from 1 to 5. “For sustainable and long-term growth, we need a well-funded operator who can build up an adequate size of fleet of different types to serve different segments with economies of scale,” comments Mansingh. “This will also help in the long-term development of adequate critical manpower for future growth.” Mansingh adds. Seconding Mansingh’s views, Dutta claims that additionally there is a need for morecomprehensive policies addressing issues such as the development of dedicated corridors forhelicopter flights, landing charges, and fuel costs to foster industry growth.

In India, single engine (Instrument flight rule) IFR and single engine night operations are not permitted in India at present as single engine helicopter is perceived as unsafe. Perceiving this rule as obsolete, B.S. Singh Deo, Vice President of Rotary Wing Society of India asserts that modern single engine helicopters are as safe as the twin engine one so there is no justification for restrictions on SE helicopters.

India’s strategic location in terms of size, varied terrains, scattered population settlements, economic growth and much more places India as one of the top contenders amongst developing helicopter markets in the world. In fact, India has the potential to be amongst the world’s biggest civil helicopter using countries, claims Airbus. “Hence now, the onus is both on the Government and industry players like ourselves to de-glamourise helicopters and position it for greater acceptability,” Airbus adds. “The final stakeholder MoCA (Ministry of Civil Aviation) however could inject limited but decisive growth through a top-down approach, should the willing authorities be adequately persuaded,” concludes Captain Kumar.

EXPECTATIONS FROM THE GOVERNMENT

However, all hope is not lost! The Government is trying to do its bit for the helicopter industry. Like last year, helicopters were included in UDAN 5.1 to achieve last mile connectivity. This means an increase in the scope of operations and increased viability gap funding for sustainable operations. “This means a move towards a deeper democratisation of air travel with a focus on last mile connectivity,” Airbus comments praising this step as a significant step towards development of helicopter industry in India.

In 2021, the Ministry announced a new helicopter policy under which dedicated hubs and corridors would be established and landing charges and parking deposits abolished to boost commercial helicopter operations in the country. Under the new policy, the Government has put together a dedicated helicopter acceleration cell in the Civil Aviation Ministry to look at helicopter industry’s issues. As part of the policy there are no landing charges or parking deposits for heliports or helicopter companies. About four Heli Hubs and Training Units will be set up in Mumbai, Guwahati, Delhi, and Bengaluru and helicopter corridors are being set up in 10 cities and 82 routes in the country.

Worldwide, helicopters are seen as an integral part of any public service delivery be it emergency health transportation, disaster response, law and order or urban mobility. Airbus believes in India’s potential as a bludgeoning giant ready to emerge any day as a major player in the helicopter market. “India is ready for the use of helicopters as a critical component of public service delivery. There is a latent appetite for on-demand air mobility not only in the urban areas but also in many parts of your mountain states,” Airbus reasons.

Industry stakeholders have various expectations from the Government with regards to the helicopter industry. Mansingh feels the Government should start with initiating fractional ownership to increase access to capital for the helicopter industry. Just recently the MoCA has decided to allow fractional ownership of business jets and helicopters to spur the growth of non-scheduled operations in the country.

Globally, employment of Helicopters in Law Enforcement and Emergency Medical Services enhances their operational viability. In India, these services are practically non-existent.

The Government can also help reform certain rules like revising the helicopter VGF and aligning it with the current operating cost and increasing it to five years to make it operational economically viable and RCS sectors. “Various state needs to step in for infrastructure -Heliport, Helipad and Navigation aid and procedure development,” Mansingh urges.Echoing Mansingh’s thoughts, Dutta also feels that Government should incentivise processes for leasing of helicopters in India. He further urges the Government to provide dedicated air corridors ensuring timeliness for flights.

Tax on helicopter flights is 18 per cent at par with business class tickets whereas Economy seats in commercial aviation is five per cent. Dutta asserts that these taxes should also be at par with the economy tomake it more democratic. B.S. Singh Deo places his bet on the large untapped skilled labour in India. He feels skill development and training should be initialised by setting up more training schools to address pilot shortage issues that are already being experienced. He also shares Captain Kumar’s perspective that rule need to change and become more liberal to allow highly experienced ex-defence pilots and engineers to get commercial licenses.

Currently there are about 35 flying training organisations and six aircraft Type Training Organisations (ATOs) for fixed-wing training as per DGCA records. The Bengaluru-based Helicopter Academy to Train by Simulation of Flying (HATSOFF) is the only helicopter training facility, and that too with a limited quota of simulators. Although setting up of setting up of India’s first helicopter ATO, FlyOla, has been approved as of now there is no dedicated training organisation offering training for a Commercial Helicopter Pilot’s Licence.

Captain Kumar feels that the reported shortfalls related to short distance segments via CAG report no. 22 of 2023 on RCSUDAN scheme are highly resolvable by efficient helicopter operations since befitting their core competency zone. ‘Icing on the cake’ is expected role of RCS-UDAN scheme in nation building initiative of ‘Gati Shakti’. Highlighted potential of helicopter sector to support RCS-UDAN scheme via its core competency in small distance segments would thus be an impetus for national ‘Gati Shakti’ initiative. Another shot in the arm would be employment of indigenous GAGAN system for heliport infrastructural development towards RCS-UDAN connectivity. Interest of the apex stakeholder, MoCA must therefore be agreed upon,” Captain Kumar adds.

A detailed talk with various industry experts and stakeholder let to the following preliminary observations and steps needed to be taken for helicopters in India to take-off, to establish feasibility and later scalability of a ‘Pilot’ project:

- Development of Heliport Infrastructure under IFR (Instrument Flight Rules): The Government needs to look at the hilly terrain withlimited road connectivity in Northern and North-Eastern Regions as a base for its ‘pilot project’ to gain maximum advantage. AAI can develop about two to four heliports with IFR infrastructure under PBN concept for linking up with identified airport(s) under RCS-UDAN scheme.

- Single-Pilot Helicopter Operations under IFR: Proposed initiatives necessitate larger population of skilled pilots. DGCA may consider measures for complementing population of trained helicopter pilots to match projected scope of nation-wide operations. Facilitating single pilot operations under IFR is one viable solution to the challenge. To put things in perspective, single pilot operations under IFR are already provisioned for aircraft in India, but capped for helicopters. This ‘cap’ restricts scope of operations and possibly impacting contribution by helicopters in nationwide schemes.

- Participation of Private Helicopter Operators: Role of Pawan Hans in shaping helicopter operations under RCSUDAN scheme has been far from praiseworthy. It may therefore be considered to invite private sector helicopter operators for wider participation and possibilities at planning levels. Economic prudence for self-sustainable operations may also be better reflected by private sector as required under RCS-UDAN scheme. The most important advantage would however be deliberations on contemporary ideas for an upward trajectory.

CONCLUSION

While helicopter policies have been liberalised, there is a long way to go. Currently helicopters policies are seen in the same lens as aircrafts whereas the helicopter is more versatile machine andpolicies need to be crafted accordingly. Going ahead India must boost the use of helicopters for the purpose of effective internal surveillance, maintenance of law and order and traffic, and civic management as part of the ‘SMART Cities’ project.