SAF – Green Gold or Greenwash?

Sustainable Aviation Fuel (SAF) is essentially about biomass and waste – including waste CO2 – being turned into “green gold”, or jet fuel, to slash emissions. However, tight supply of raw materials and high production costs make large-scale SAF production challenging.

All the evidence indicates that planet Earth is heating up, and fast. In May 2023, the World Meteorological Organization (WMO) issued a report that projects a 66 per cent likelihood that the world will exceed the internationally agreed 1.5 degrees Celsius threshold within the next four years. Scientists believe that a rise of 1.5 degrees Celsius is a climate change “red line” and overshooting it even for a few years is risky. It may trigger tipping points that cannot be uncrossed – such as the melting of permafrost that would, in turn, release huge amounts of trapped CO2 and intensify global warming. The UN Secretary-General Antonio Guterres has given a stark warning that the planet is “nearing the point of no return”.

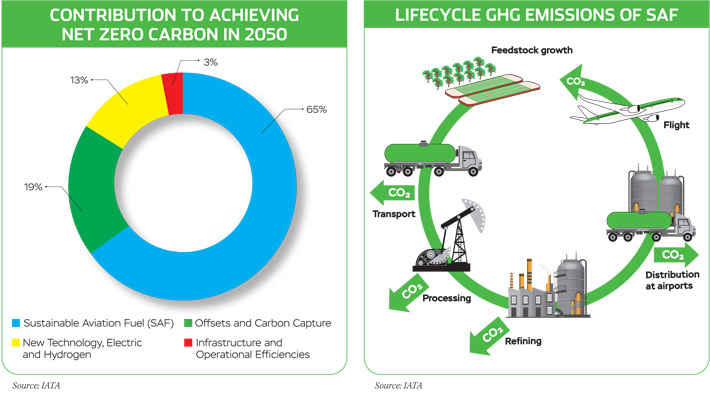

The need to switch to greener fuels therefore has never been more urgent. The UN Climate Change Conference (COP28) summit, in Dubai in December 2023, for the first time took explicit aim at the use of fossil fuels and agreed a new commitment to reduce their use. It reemphasised the importance of reaching net zero by 2050 to avert the worst consequences of global warming. Net zero is a state where the amount of greenhouse gases (GHG) produced is balanced by the amount removed from the atmosphere.

Many sectors of the economy are making significant strides in the transition to more environmentally friendly fuels. So is the aviation industry, which currently contributes just 2.5 per cent of global emissions. However, air travel is incredibly difficult to decarbonise and it is still one of the fastest growing sources of emissions. Commercial aviation is rebounding rapidly after COVID-19, and the International Air Transport Association (IATA) anticipates a full recovery this year. By 2025, IATA expects global passenger numbers to reach 4.6 billion and surge to 10 billion by 2050. Fuel consumption will correspondingly balloon. In fact, aviation’s share of global emissions could easily triple by 2050.

In 2021, therefore, IATA’s member airlines committed to achieve net zero carbon emissions from their operations by 2050. Besides new aircraft technologies, more efficient operations, direct carbon capture (DCC) and credible offsetting schemes, IATA’s strategy towards making aviation sustainable rests mainly on Sustainable Aviation Fuel (SAF). Indeed, as much as 65 per cent of the reduction of GHG emissions required to attain the industry’s challenging net zero goal is expected to come from SAF.

SIMPLIFYING SAF

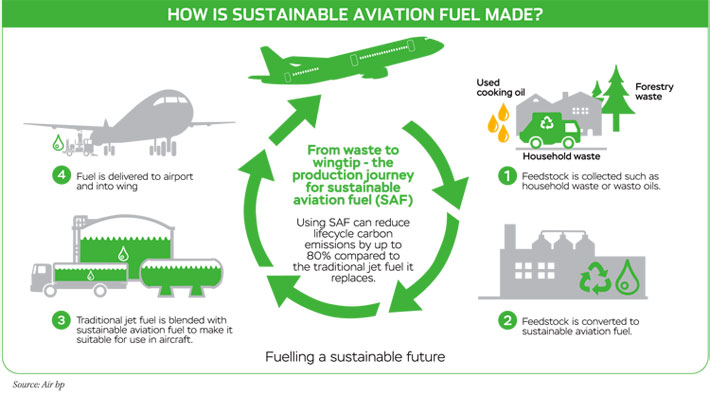

SAF is a liquid fuel used in commercial aviation that can reduce lifecycle CO2 emissions by up to 80 per cent. It is produced from sustainable resources and can be mixed with fossil jet fuel to reduce emissions. The term “sustainable” highlights the fact that the production process does not have a detrimental impact on the environment, since it involves neither deforestation or land use change, nor does it require large amounts of fresh water. It also implies that the feedstock is obtained by focusing on waste-to-fuel and power-to-liquid (PtL) solutions, not by usurping arable land from farmers. It is a “drop-in” fuel, meaning it can be added without changes to the aircraft or infrastructure. According to the Geneva-based Air Transport Action Group (ATAG) over 7,00,000 commercial flights have been operated using SAF since 2011. Across the globe, 69 airports are currently regularly supplied with SAF.

In April 2023, the European Union Commission announced new regulations regarding the use of SAF. They require aviation fuel suppliers to blend a minimum percentage of SAF with traditional jet fuel at EU airports. It will start at 2 per cent in 2025 and increase to 70 per cent by 2050. Other countries are expected to promulgate their own blending targets.

SAF TECHNOLOGIES

SAFs can be produced from a variety of feedstocks (42 at last count) and through several different technologies, each with its own set of challenges. SAF conversion processes are evaluated and approved by organisations such as ASTM International. As of July 2023, 11 conversion processes for SAF production had been approved and seven other conversion processes were under evaluation.

In the PtL process, capturing CO2 released during combustion and combining it with hydrogen forms a “virtuous circle” in that the CO2 that is emitted by burning is itself reused to create more fuel

Researchers are continuously developing and refining new ways to create SAF and to produce it at lower cost from an expanding set of technologies and feedstocks.

- First Generation SAFs. These are the cheapest, simplest to produce and hence most commonly available type. They come from fats, oils and greases (FOGs). They reduce CO2 emissions by 50 to 80 per cent compared to normal jet fuel over the lifecycle of the product. The obvious problem is limited availability of feedstocks which prevents significant scaling up of production.

- Second Generation SAFs. These types of SAF are obtained from biomass and municipal solid waste and can potentially reduce GHG emissions by 85 to 95 per cent over their lifecycle. Biomass may include algae, crop residues, animal waste, forestry residues and sludge. However, production often requires advanced technologies and complex processes, such as thermochemical or biochemical conversion, that are rather expensive and energy-intensive.

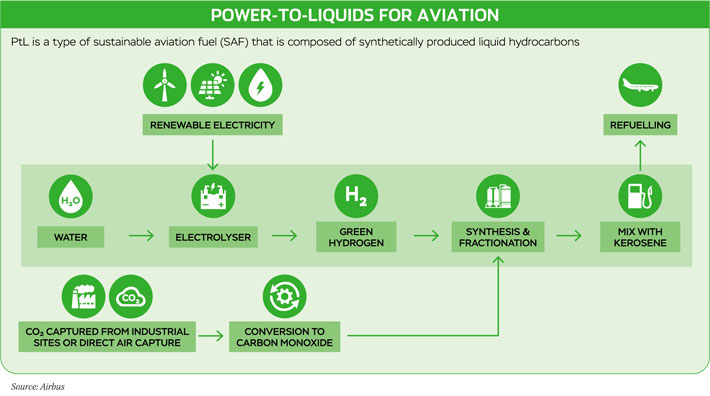

TURNING POWER TO LIQUID

While both first and second generation biofuels offer significant GHG savings, it is very unlikely that they will ever be available at the scale needed to decarbonise global commercial aviation. Hence intensive research is in progress towards e-fuels, also known as electrofuels. E-fuels are synthetic fuels that are prepared from renewable energy sources and captured CO2. They are made using a process called “power to liquid” (PtL) that produces liquid hydrocarbons synthetically. Renewable electricity is the key energy source, and water and CO2 are the main raw materials used in PtL production, which consists of three main steps:

- Renewable energy powers electrolysers to produce green hydrogen.

- Climate-neutral CO2 – captured by, for example, Direct Air Carbon Capture (DACC) – is converted into carbon feedstock.

- Carbon feedstocks are synthesised with green hydrogen – via processes such as Fischer-Tropsch – to generate liquid hydrocarbons. These are then converted to produce a synthetic equivalent to kerosene.

Capturing and storing CO2 are central to the production of PtL. In fact, capturing CO2 released during combustion and combining it with hydrogen forms a “virtuous circle” in that the CO2 that is emitted by burning is itself reused to create more fuel.

PtL is a potential solution to reduce GHG emissions from the transport sector, especially for long-distance freight, marine, and air transport. However, it requires a lot of energy to produce and incurs high production costs, which is a major drawback. According to various studies, the production cost per litre of PtL kerosene can vary widely, ranging from three to six times that of traditional fossil fuels.

TESTING TIMES

Aircraft and engine manufacturers are also striving to advance their SAF initiatives. Currently SAF approved for use is a synthetic component blended with petroleum-based Jet A or Jet A-1 fuel up to 50 per cent. However, an international task force led by one of GE Aerospace’s experts is developing standardised industry specifications supporting the use of 100 per cent drop-in SAF, which does not require blending with traditional jet fuel. Some airlines have already conducted long-distance flights with one engine powered entirely by SAF.

GE and its joint venture partners are leading efforts to conduct engine testing and demonstrations which can provide valuable data to support development of 100 per cent SAF standards. In December 2023, GE Aerospace reached a significant milestone in successfully testing ten different aeroengine models using 100 per cent SAF since 2016. The engines include a mix of propulsion systems used in commercial, military, business, and general aviation aircraft. The ongoing research aims to understand the impact of 100 per cent SAF on engine performance, emissions, and contrails. Suitable standards are also required to be formulated to allow any type of SAF to be freely used on any commercial aircraft anywhere in the world – much like normal jet fuel at present.

The Indian government needs to establish a proper roadmap and economic incentives for SAF production so as to cash in on the golden opportunity to produce and even export SAF

On November 28, 2023, Virgin Atlantic became the first commercial airline to complete a transatlantic flight using 100 per cent SAF. The Boeing 787 took off from London and landed safely in New York City, thus demonstrating that SAF is a viable alternative to traditional jet fuel and is compatible with current engines, airframes, and fuel infrastructure. However, as a matter of abundant caution for passenger-carrying planes, both Boeing and Airbus are committed to building aircraft specifically designed to run on 100 per cent SAF by 2030.

PRODUCTION PAINS

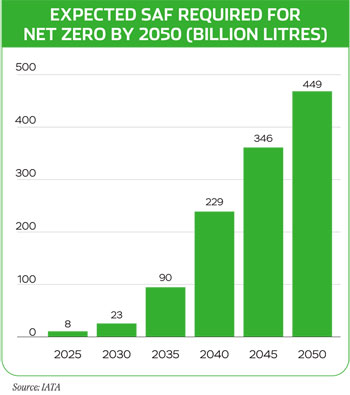

In 2023, SAF constituted just 0.2 per cent of global jet fuel volumes, yet the aviation industry views SAF as the most feasible near-term option. Although electric motors and hydrogen burning turbines show immense promise, they are probably decades away from large scale commercialisation. Unlike SAF, they will also require transformational changes in aircraft, engines, airports and various supporting facilities.

IATA predicts that the airline industry will require almost 450 billion litres of SAF by 2050. Against this only 300 million litres were produced in 2022, while the estimate for 2023 is 600 million litres. Production is projected to triple to 1.875 billion litres in 2024 but even at such dramatic rates of growth there is likely to be a huge shortfall in meeting the 2050 requirement.

IATA believes that 30 billion litres of SAF is a tipping point for SAF production and utilisation for commercial aviation. However, SAF production costs currently exceed those of traditional jet fuel by a large amount, driven by feedstock shortages and early-stage market factors. There’s simply not enough SAF being produced, and in order to reach production at scale, significantly higher investment is essential.

INDIA’S INITIATIVES

Around 145 countries have announced – or are considering – net zero targets. If all these pious intentions translate into real action they will cover about 90 per cent of global carbon emissions. India has pledged to reach net zero by 2070. It has also made a small start towards the use of SAF. In November 2023, the National Biofuels Coordination Committee (NBCC), chaired by Union Petroleum Minister Hardeep Singh Puri, set the indicative SAF blending percentage at 1 per cent for 2027 and 2 per cent for 2028. These will initially apply only to international flights.

In December 2023, GE Aerospace reached a significant milestone in successfully testing ten different aeroengine models using 100 per cent SAF since 2016

The nation’s inaugural commercial-scale SAF plant at Panipat, built by state-owned Indian Oil Corporation (IOC) should be up and running by 2026. Mangalore Refinery and Petrochemicals Limited (MRPL), a subsidiary of ONGC, also has plans to commence SAF production. Initially it will be a small 20-kilolitre-perday plant to demonstrate indigenously-developed technology. Subsequently, it will need about two-and-a-half years to set up the main plant at an estimated cost of around 450 crore. These and other industry initiatives are essential to support the government’s one per cent SAF blending target. The government needs to establish a proper roadmap and economic incentives for SAF production so as to cash in on the golden opportunity to produce and even export SAF. This would also help India meet its commitment of net zero carbon emissions by 2070.

BOOSTING PRODUCTION IS THE KEY

SAF is essentially about biomass and waste – including waste CO2 – being turned into “green gold”, or jet fuel, to slash emissions. However, tight supply of raw materials and high production costs make large-scale SAF production challenging. IATA’s Director General, Willie Walsh, says, “Despite unequivocal demand signals, the SAF production market is not developing fast enough. We need SAF everywhere in the world, and to that end, the right supportive policies – policies that can stimulate production, promote competition, foster innovation, and attract financing – must be put in place today.”

Without the right policies, there is a significant risk that global SAF production will fall well short of the requirement. That is one reason why environmental activists are openly sceptical about what SAF can achieve, terming the whole exercise as mere “greenwash”. They advocate urgently reducing flights wherever possible as the only way to genuinely reduce aviation’s climate change impact.

However, that is clearly not something the aviation industry would like. Commercial aviation has experienced and surmounted numerous challenges during its long history. And the industry views the transition to large-scale use of SAF as just another challenge to be robustly faced.