CAPA Indian Aviation Industry Outlook

Consolidation is still looked at as a high probability amongst Indian airlines, even after Air India’s privatisation

For India, the aviation industry is on an interesting turn as new airlines have entered, new regional routes have been added, changes in the number of aircraft expected in operations, new airports being created and policies are being documented.

GDP growth slipped in FY 2022 (April 2021–March 2022) due to a dip in private consumption and slowing industrial production. Government spending lending support to the economy. Unemployment rates and labour participation rates remained below pre-Covid Levels. Consumer sentiment and expectations indices improved but yet to reach pre-pandemic levels.

Merchandise trade, and trade deficit reached historical highs of $1+ trillion and $192+ billion. Import of petroleum, electronic goods, and gold contributed to the high deficit.

Industry credit picked up largely due to MSMEs - in part attributable to Covid relief-related support. Low credit offtake by large corporates given limited capex plans and other funding options.

For FY 2022, the INR averaged an exchange rate of 74.5/USD and hit the 77/USD mark. It depreciated by 3.6 per cent against the USD. INR depreciation amidst higher volatility is expected to continue in FY 2023 (April 2022 – March 2023).

The INR was under pressure due to

- worsening terms of trade especially high crude oil prices

- monetary policy and quantitative tightening by developed market central banks across the globe

- USD strength

- risk aversion sentiment towards EM assets and currencies.

Various macro headwinds are expected to result in the depreciation of the INR. Amidst the volatility, the RBI will step in to ensure an orderly outcome. For FY 2023 the INR is estimated to average 78-80/USD range. Volatility may cause the exchange rate to rise to 83/USD.

Tough higher volatility is expected in FY 2023, especially if there is a sharp move in the USD and/or a sharp decline in oil prices, the RBI will step in to create an orderly path for the currency’s depreciation. Further, the RBI has been acting on the forward markets to protect forex reserves as it attempts to support the currency from very high volatility.

Indian airlines are estimated to report a loss of $3.0 billion (after adjustments) for FY 2022. This estimate is lower than the forecast by CAPA Advisory in its outlook for FY 2022.

DOMESTIC AND INTERNATIONAL TRAFFIC TO BE IN THE RANGE OF 130-140 MILLION AND 55-60 MILLION IN FY 2023, RESPECTIVELY

| Category | FY 2023 outlook | Comments |

|---|---|---|

| Domestic traffic | ||

| International traffic | ||

| Profitability | ||

| Crude & forex |

Source: CAPA Advisory research and analysis

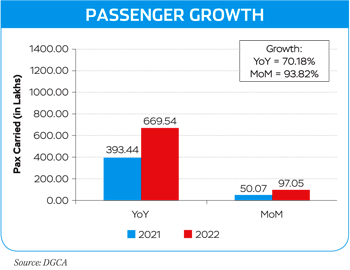

Stronger-than-expected recovery was seen in international traffic in terms of airline passengers in 2022. 15.9 million international passengers in H2FY 2022, with daily passengers in Mar-2021 standing at 1,06,000. 55.1 million domestic passengers in H2FY 2022, with daily passengers in March-2021 reaching 3,41,000.

International traffic is catching up with domestic traffic as a result of reduced travel restrictions and the resumption of scheduled services in March 2022.

CAPA Advisory expects domestic and international traffic to be in the range of 130-140 million and 55-60 million in FY 2023, respectively.

When it comes to domestic traffic, possibility of higher airfares negatively affecting demand. While for, international traffic, recovery to pre-COVID level expected in H2FY 2024.

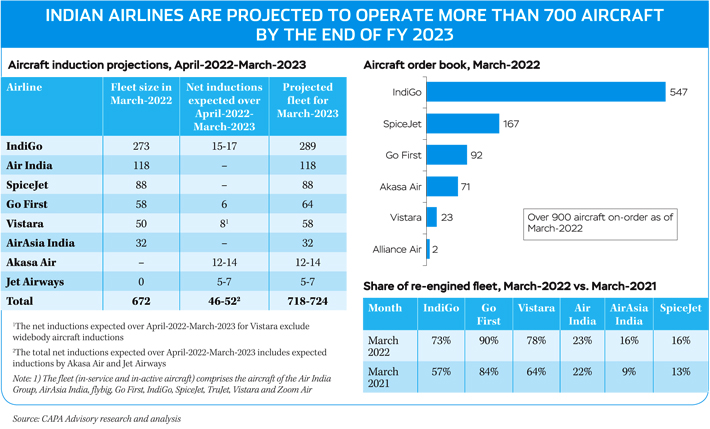

Indian airlines are projected to operate more than 700 aircraft by the end of FY 2023, an increase of 46-52 aircraft vis-a-vis the level in FY 2022.

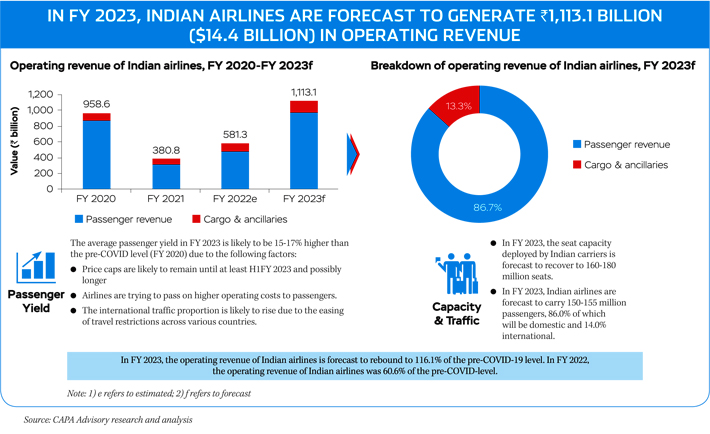

In FY 2023, the operating revenue of Indian airlines is forecast to rebound to 116.1 per cent of the pre-COVID-19 level. In FY 2022, the operating revenue of Indian airlines was 60.6 per cent of the pre-COVID-level. In FY 2023, Indian airlines are forecast to generate 1,113.1 billion ($14.4 billion) in operating revenue, including 147.6 billion from cargo and ancillaries. The average passenger yield in FY 2023 is likely to be 15-17 per cent higher than the pre-COVID level (FY 2020) due to the following factors:

- Price caps are likely to remain until at least H1FY 2023 and possible longer

- Airlines are trying to pass on higher operating costs to passengers

- The international traffic proportion is likely to rise due to the easing of travel restrictions across various countries.

- In FY 2023, the seat capacity deployed by Indian carriers is forecast to recover to 160-180 million seats.

- In FY 2023, Indian airlines are forecast to carry 150-155 million passengers, 86 per cent of which will be domestic and 14 per cent international.

In FY 2023, Indian airlines are forecast to see 21.2 per cent higher operating expenditure than the pre-pandemic level. Higher fuel prices and the depreciation of the currency against the US dollar will increase costs.

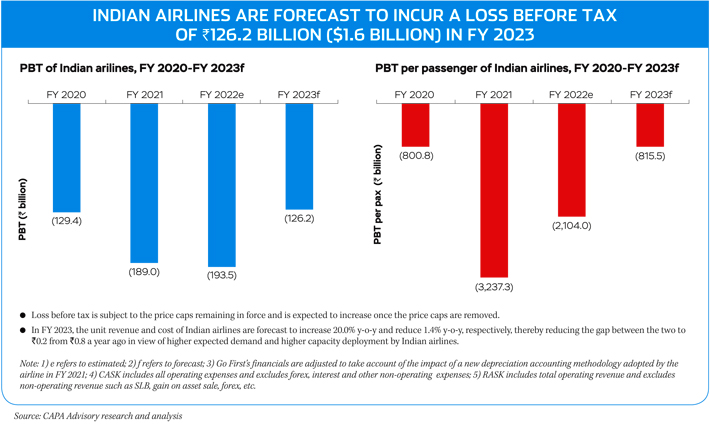

Indian airlines are forecast to incur a loss before tax of 126.2 billion ($1.6 billion) in FY 2023, translating into an 815 ($10) loss per passenger.

Indian airlines are estimated to report a loss of $3.0 billion (after adjustments) for FY 2022, while stronger-thanexpected recovery was seen in international traffic in terms of airline passengers in 2022

Indian airport operators are forecast to generate 218.7 billion ($2.9 million) in revenue for FY 2023, representing a 94.4 per cent recovery against the pre-COVID-19 level.

The Indian airport industry is likely to witness over 30 per cent jump in operating expenses in FY 2023 over FY 2022, largely on the back of resumption of revenue sharing with AAI. The Indian airport industry is forecast to report a pre-tax profit of 128.5 ($1.7) per passenger in FY 2023.

INDIA OUTLOOK FY 2023

- The industry will require recapitalisation of around $2-2.5 billion.

- Consolidation is still looked at as a high probability amongst Indian airlines, even after Air India’s privatisation. The longterm impact of COVID and likely losses in FY 2023 will make it very difficult for the sector to raise funds for some.

- Consolidation is also expected in the airport sector within the next 12 months, possibly sooner.

- Indian aviation will consolidate around 2-3 major players in each segment which will have a critical impact on consumer interests and competition in the near term.

- For airlines, this post-COVID phase is characterised by a very hostile cost environment, increased competition and tough economic conditions, a combination that is expected to prove highly challenging.

- Domestic traffic is expected to reach 130-140 million passengers, perhaps remaining slightly lower than the FY 2020 levels. The impact of higher fares on demand is becoming visible in Q2 with traffic recovery slowing down.

- International traffic is expected to reach 55-60 million passengers, around 20 per cent below pre-COVID.

- Airlines losses are expected to moderate from around $3 billion in FY 2022 (including adjustments) to around $1.4-1.7 billion.

- Airlines are unlikely to continue with current fare levels, especially in Q2. Fares are expected to moderate significantly in Q2 and going forward.

- Indian airports are expected to report a modest profit of $420 million.

- Airport deliveries are expected to be moderate at around 40+ inductions. Net additions to the fleet will be lower due to some of these aircraft being for replacement.