Airlines’ Finances Improved in Q2 2021: IATA

Initial Q2 2021 results show that net losses of airlines at the aggregated level diminished compared with Q1 2021.

Over a year after the pandemic, the aviation industry is tracing its way back through a long uphill climb. The financial losses that the airlines are coping with as the after effect of this pandemic is significantly high. It’s been the lowest time for the industry. However, the finances of airlines are showing some positive signs as travel has softly restarted after vaccination drives. The second quarter of the year saw the airlines witnessing some improvement with the finances. “Initial Q2 2021 results show that net losses of airlines at the aggregated level diminished compared with Q1 2021. In particular, North American airlines’ financials showed a significant improvement amidst the rebound in US domestic travel,” stated International Air Transport Association (IATA).

The association also mentioned that the global airline share price index increased in August following the FDA approval of COVID-19 vaccines in the United States (US). However, the year-to-date performance of global airline stock index is still lagging wider global equity markets.

As the domestic traffic bounced back in the US owing to the progress in the vaccination drives, North American airlines’ bottom-line at the aggregated level turned to positive. North American and Latin American airlines came out as the best performers in the second quarter with improvements in domestic as well as regional traffic during the quarter. However, Asia Pacific and European airlines did not witness a major improvement because of dampened international travel, which represented an important source of these airlines’ revenues before the crisis, pointed out IATA.

AIRLINE FINANCIAL RESULTS

| Number of Airlines in Sample | Regions |

|

| ||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

|

1% of revenues, 2US$ million

Source: The Airline Analyst, IATA

PASSENGER REVENUES

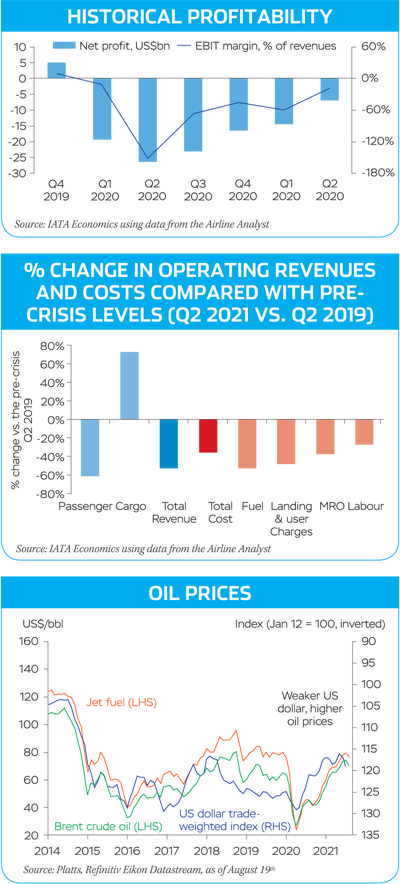

The second quarter of 2021 also saw passenger revenues decline by 60 per cent compared to those in the pre-crisis quarter i.e. Q2 2019. At the regional level, it was again the North American airlines that displayed the best outcome (-49 per cent). The overall industry-wide improvement has been largely driven by North American airlines. Asia Pacific and European carriers posted passenger revenues down 63 per cent and -66 per cent, respectively compared with the pre-crisis level, according to IATA. North American carriers at the aggregate turned to positive both in operating and free cash flow generation. Cash flow of some of the major European carriers also turned positive since the beginning of the pandemic. This was a result of the boost in passenger bookings for summer travel along with the progress in vaccination.

Cargo revenues, that have remained firm, continued to be strong supporters for airlines (up 72 per cent). The demand as well as yields have stood to be robust for the cargo sector.

Cargo revenues, that have remained strong, continued to be strong supporters for airlines

“The fall in operating costs in Q2 2021 (-35 per cent) remain short of the decline in revenues. Across the key cost items, while fuel costs and user charges declined by 52 per cent and 48 per cent, respectively, the fall in labour cost was limited to -27 per cent,” IATA mentioned in its analysis report.

OIL PRICES

Fluctuations in the oil prices have also played a role in affecting the airlines’ finances. The average Brent crude oil and jet fuel prices also stroked down in August amidst concerns of the new delta variant of the coronavirus. The outbreaks due to delta in some regions resulted in restrictions that are expected to hit oil demand and slow global economic recovery. “The additional downward pressure on prices came from the increase in OPEC+ oil output in August. The deterioration in the pandemic developments has been reflected in the latest International Energy Agency (IEA) oil demand forecast that was downgraded for the rest of the year. The average price of jet fuel year-to-date is $71.6/bbl, which is broadly in line with our forecast for 2021,” stated IATA.

SPREAD OF COVID-19 VARIANTS

Although the initial second quarter this year brought a brighter financial scenario, showing that net losses narrowed down and the financial performance of the airline industry at the aggregated level improved considerably, the risks for further recovery are not entirely promising for the coming quarters given the new COVID-19 restrictions that are affecting some domestic markets which were on the recovery track. Added to that, large domestic markets that are on the recovery track and the intense restrictions on international travel positon inconvenient risks to the recovery.

Amongst key domestic markets, Russia also had good outcome through booming domestic tourism. On the other hand, recovery in Australia returned amid new travel restrictions imposed to fight new COVID wave.

The concerns about the fast spreading COVID-19 Delta variant resulted in sharp decline in airline share prices atthe beginning of August, reported IATA. However, the approval of several COVID-19 vaccines by FDA in the United States and decline in cases in China brought some optimism later in the month. This lead to airline share prices increasing again in North America and Asia Pacific in August compared with the previous month.

Both international and domestic travel demand showed significant momentum in July 2021 compared to June, but demand remained far below pre-pandemic levels. Total demand for air travel in July 2021 (measured in revenue passenger kilometers or RPKs) was down 53.1 per cent compared to July 2019. This is a significant improvement from June when demand was 60 per cent below June 2019 levels. International passenger demand in July was 73.6 per cent below July 2019, bettering the 80.9 per cent decline recorded in June 2021 versus two years ago.

Bookings for August travel have been falling. The weakness has been largely driven by China domestic market where the latest COVID outbreak resulted in a shutdown of many important routes. As of August, the year-to date performance of global airline stock index was still lagging wider global equity markets (3.9 per cent vs 13.8 per cent). However, extensive governmentimposed travel restrictions and uncertainty around new variants continues to delay recovery in international markets.

“The problem is border control measures. Government decisions are not being driven by data, particularly with respect to the efficacy of vaccines. People traveled where they could, and that was primarily in domestic markets. A recovery of international travel needs governments to restore the freedom to travel. At a minimum, vaccinated travelers should not face restrictions. That would go a long way to reconnecting the world and reviving the travel and tourism sectors,” said Willie Walsh, IATA’s Director General.

The growing number of fully vaccinated travelers and the prevalence of testing provided the chance to restore international connectivity and bring much needed relief to economies that are heavily reliant on travel and tourism, he added.