The New Normal

While uncertainty looms large over global travel’s restoration, the airline industry has to overcome the financial grievances as well as innovate for transforming consumer behavior

After the widespread travel restrictions across the globe due the pandemic and the fallen demand, the destinations worldwide welcomed 1 billion fewer international arrivals in 2020. Since then the airline industry has been through a downturn as deep as any it has ever experienced, stated the United Nations World Tourism Organisation (UNWTO). As the restrictions started to ease, the emergence of new variants of the novel coronavirus have again nudged the governments to reverse the opening, with almost entire closures most prevalent in Asia and the Pacific and Europe.

A report from McKinsey industry action group reported that in 2020, the airline industry revenues totaled $328 billion, around 40 per cent of the previous years. “In nominal terms, that’s the same as in 2000. The sector is expected to be smaller for years to come; we project traffic won’t return to 2019 levels before 2024,” it stated.

While uncertainty looms large over global travel getting back to normal, the pandemic has also transformed travel behaviours. As airlines deal with the hit, they not only have to recover but also restructure and reinvent with the changed scenario. Gaining consumer confidence specifically with safety and hygiene along with convenient procedures will be significant.

The international marketplace, Skyscanner’s Horizons report also revealed the emergence of new travel behaviours. These changed behaviours are likely to stay long-term and profound. The 2008 crisis was largely economical, however this one is also transforming consumer behaviour and operational structures, which is what the airline sector will have to look into.

According to CAPA, deferrals represent one of the main tools airlines have available for pausing growth and reducing fleet costs, along with early retirements, lease returns and order cancellation.

Restructuring and redesigning the aircrafts and routes, exploring innovative technologies, treading the cost-effectiveness with the change in demand, ensuring safety await the airlines ahead. Some of the areas that will define the new normal for the airlines, are listed below.

RESTRUCTURING, REDESIGNING & REROUTING

With more and more people getting vaccinated, travelling within the country certainly has an upper hand as international travel is still likely to face delay. Passengers are also willing to spend less and travel to unexplored local destinations instead of the usually thronged tourist spots. This will lead to increased domestic travel, and restructuring of routes. As and when travel bubbles emerge before entire international travel starts, the routes will again be impacted based on that.

In March 2021, Ministry of Civil Aviation (MoCA) had proposed about 392 routes under UDAN 4.1 bidding process. The Regional Connectivity Scheme (RCS)-UdeDeshKaAamNagrik (UDAN) is a flagship scheme of the MoCA Government of India” after to make air travel affordable and widespread in the country, boost inclusive national economic growth, employment opportunities, and air transport infrastructure development across the nation. Till then, 325 routes and 56 airports including 5 heliports and 2 Water Aerodromes have been operationalised under the UDAN scheme.

Usha Padhee, Joint Secretary, MoCA said, “Following the four successful rounds of bidding, the special UDAN 4.1 bidding round invites bids for priority routes which have not been covered under UDAN so far. We have observed great demand on many Tier-2 & Tier-3 UDAN routes attesting the necessity along with essentiality & criticality of these regional routes.”

In the international market, the Skyscanner’s analysis of the industry revealed that the leisure/VFR (visiting friends & relatives) markets, particularly domestic and short-haul international, will be in the ascendency. For the airlines that are in this situation, low cost carriers are very well placed. Thereby, airlines will have to look into reevaluating their economics of operation, especially long-haul flights. Another change that the airlines might consider exploring would be the reconfiguring of the cabin layouts.

When it comes to the prices there are two sides to this coin. While people are looking for more feasible options, the reduced frequency and demand, and the financial lag have taken the prices up for most airlines. At the same time, the airlines are also exploring new routes, which is likely to reduce the economic burden. This will be a tricky balance for airlines to maintain especially in countries like India.

Investing in the right tools and technology can not only help monetise assets better but also significantly improve operating efficiency and customer experience

Carolyn Prowse, the Chief Commercial Officer of the Mexican low-cost airline, Volaris touched upon these points in a CAPA (Centre for Aviation) live session sharing the airline’s recovery story. Established in 2006, Volaris has grown to an impressive market share of over 40 per cent of the Mexican domestic market in the restart since the depths of COVID-19. “There are three different elements to our ultra-low-cost model that have made us successful in terms of the recovery. The first is that we are very focused on leisure and the VFR traffic, and that makes up over 70 per cent of our business. And those are the segments that have rebounded more quickly coming out of this pandemic. The second thing is that all of our capacity is domestic or regional, and the final element is that our costs have allowed us to stimulate demand with the low base fares, as we’ve seen the first signs of recovery, but also to be able to make this up in the ancillary revenue. Our ancillary per passenger was 36 per cent higher than in the previous year, and it now accounts for approximately 50 per cent of our revenues,” said Prowse.

DIGITISATION DOSE

We are all aware how the pandemic transformed the world with digitisation, shifting technology years ahead. Transfer of many human tasks to contactless during the course of travel is going to be the key. This digitisation will also activate most of the work through apps and phones with increased touch-less check-in, face recognition technologies, RFID bag-tags, paperless immigration, etc. This will also be an aid to sustainability which has been more under focus with the pandemic.

Common travel passes like that introduced by the International Air Transport Association (IATA), or a destination tracker announced by UNWTO and IATA will become more common to boost confidence and accelerate recovery of the sector. Many countries and organisations are deliberating on digital certificates as well that would include an individual’s update around the vaccines, infection, etc. all in one place.

Like it or not, airlines will have to invest more on digitisation. The Mckinsey report noted that before the pandemic, airlines spent roughly 5 per cent of their revenue on IT and this will have to go up because in a progressively digital world, “bytes carry more value than bricks if used well”. Investing in the right tools and technology can not only help monetise assets better but also significantly improve operating efficiency and customer experience.

The use of artificial intelligence and other innovations like automated gates have been introduced even earlier but the post-coronavirus world will witness an acceleration of such trends to facilitate socially-distanced journeys.

COLLABORATION

One thing that is very clear after the pandemic is that we need collaboration among the different sectors of the industry and standardisation of policies and protocols for a smoother travel experience. Various airlines will have to come together and collaborate with each other for standard procedures as well as intersect with the government bodies for establishing common protocols. In a meeting, UNWTO Secretary-General Zurab Pololikashvili, stressed the continued need for coordination at the very highest level, in order to advance “common, harmonised criteria for the easing of travel restrictions, and for increased investment in systems that support safe travel, including testing on departure and on arrival.” An amalgamation of airlines, airports, and authorities will be a crucial aspect in evolving the ecosystem of the industry.

FREIGHTER FLEET

During the past year, the industry has witnessed an increased use of cargo as opposed to the low cargo rates that prevailed prior to the pandemic with the rise in e-commerce, and the transportation of medical goods. Before the pandemic, cargo typically made up around 12 per cent of the sector’s total revenue, however that percentage tripled last year, as noted in the Mckinsey report. Data from the Airline Analyst revealed only 21 of the airlines globally (that disclosed their operating performance) achieved positive operating profits for the third quarter of 2020, traditionally the industry’s most profitable quarter. Among these 21 airlines, cargo revenue accounted for 49 per cent of total revenues on average. Considering this high demand and low supply of air freight at present, airlines could investigate short-to-medium-term opportunities to boost their cargo services.

IATA is expecting air cargo to continue to outperform other modes of transport with volumes to grow by another 13 per cent

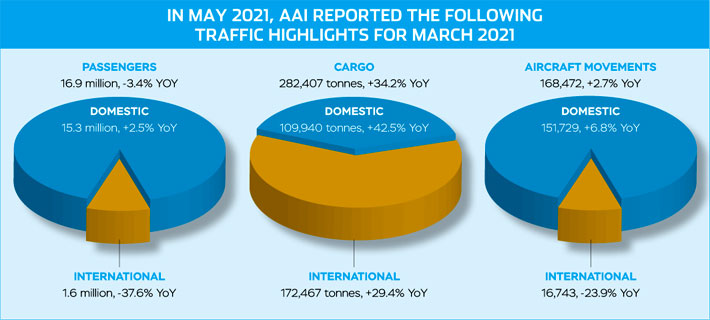

Many carriers even in India, from Air India to SpiceJet to IndiGo have been engaged with cargo transportation through the last year while passenger flights were suspended. According to the Airports Authority of India (AAI) there was a decline in passengers on direct flight by 3.4 per cent in March 2021 while cargo was up 34.2 per cent.

IATA stressed that the air cargo industry is at the threshold of a giant leap into digital transformation as passenger airlines discover its vital cash-generating contribution to their survival during the pandemic. The international association is expecting air cargo to continue to outperform other modes of transport with volumes to grow by another 13 per cent.

POLICY CHANGES

CAPA-India also reflected on the challenge by quoting that Indian carriers under-recovered almost $70 per passenger in FY21 and the twin shocks of the first and second waves, occurring in the space of a little of over 12 months, will leave a longterm structural impact. This further directs to the possibility of creating policy and regulatory challenges. CAPA India again urged MoCA to create a new policy framework.

AVIATION TRENDS IN ASIA AND INDIA

Centre for Aviation suggested that aircraft deferrals will play a key role in Asian airline recovery. Although several airlines acted quickly and secured deferrals relatively early in the pandemic, some important negotiations have occurred more recently. These latest arrangements highlight the differing approaches to deferrals being taken by the region’s airlines, CAPA stated citing the examples of Korean Air and Singapore Airlines that have made substantial deferrals to push back spending commitments while also preserving their long term fleet renewal strategies. According to CAPA, deferrals represent one of the main tools airlines have available for pausing growth and reducing fleet costs, along with early retirements, lease returns and order cancellation.

After the surge in the COVID cases since late March, the delay in recovery is furthermore determined for airlines especially in India. Most Indian airlines were already very vulnerable prior to COVID, with weak balance sheets and poor liquidity, and COVID inflicted massive losses and an increasing debt burden on carriers that were structurally ill-equipped to absorb this impact, CAPA India noted.

Some key trends shared by CAPA for Indian aviation in FY2022 after the second wave are as follows:

- Consolidation process to be accelerated

- Supply-side risks increased. If realised, this will create a strategic dilemma for policy makers and regulators.

- Demand uncertainty exacerbated. Domestic airline traffic for the full year will nevertheless be higher than the approximately 53 million passengers in FY2021.

- Indian Government’s commitment to privatisation remains. The chances of a successful divestment of Air India may be less certain.

- The entire industry will report serious losses in FY2022, similar in scale to FY2021, with a serious downside risk in the event of a protracted second wave, or the emergence of a third wave.

- The current ‘bubble arrangements’ likely to continue. Limitations for passenger belly capacity will be positive for freighter operators.

- IndiGo likely to emerge significantly stronger than its competitors. Nevertheless, IndiGo will also feel a very significant impact.