Business Aviation in India: Unable to Cross the Chasm

A comparison of markets with equivalent income as compared to the USA and Europe suggests that India has an untapped demand of around 15,000-20,000 people who can afford private aviation at least partially

|

Captain Abhishek Sinha is the creator of Insta Charter, a tech platform, created for air charter operators and brokers to find relevant air charter businesses. |

20 per cent of the Private Aviation in Asia Pacific includes destinations in India, which is more than China, Japan and Hong Kong put together. The Global Private Air Charter Business valued at $28 billion is expected to grow at about 5 per cent CAGR with the maximum growth coming from the APAC region estimated at over 7 per cent. The APAC market is likely to cross $7 billion by 2023.

The Number of Business Jets in India grew 500 per cent between 2006-2012. With more than 100 aeroplanes delivered to India within a short period, most Business aircraft manufacturers were bullish on the Indian market and opened offices in India at that time. Most reports predicted growth between 10-12 per cent for the next 20 years. By that assessment, India should have more than 330 business aeroplanes in India. Contrary to the expectations today there are less than 190 Business jets in India with an average Aeroplane age of more than 15 years.

The demand-supply gap is nearly 30 per cent in the existing market and over 100 per cent in the potential market with supply being way short of what it should be

This essentially implies that either the demand was hugely overestimated while making the projections or Business Aviation has not been able to organise itself into a growth-oriented and competitive industry as part of the global ecosystem.

Demand

The growth of UHNWI in India is growing steadily above 12 per cent. As a region, Asia is looking at a 33 per cent increase in UHNWI between 2021-2026. As an estimate, nearly 18 per cent of existing on-demand charter requests remain unfulfilled and another 15 per cent are a compromise in terms of class of aircraft or service. Amongst Asians, Indians in particular are spending more on experiences than ever before but private air travel has not been able to find a place in their lifestyle bucket list yet. Putting a number to the untapped domestic market would only be hypothetical but a comparison of markets with equivalent income as compared to the USA and Europe suggests that India has an untapped demand of around 15,000-20,000 people who can afford private aviation at least partially. At a very conservative figure of 25 hours per year of flying and only 50 per cent penetration in the potential market, this is nearly 2,25,000 hours of flying in a year. This is purely the business aviation market excluding Medical Evacuation. But this market is different from the traditional private air travel market in India. For this segment, it's not only about status but about real convenience of time, experience and price.

While the operators are heavily regulated, the air charter brokers have no requirements at all. In India to be a train ticket booking agent requires more regulatory approvals than an air charter broker.

Supply

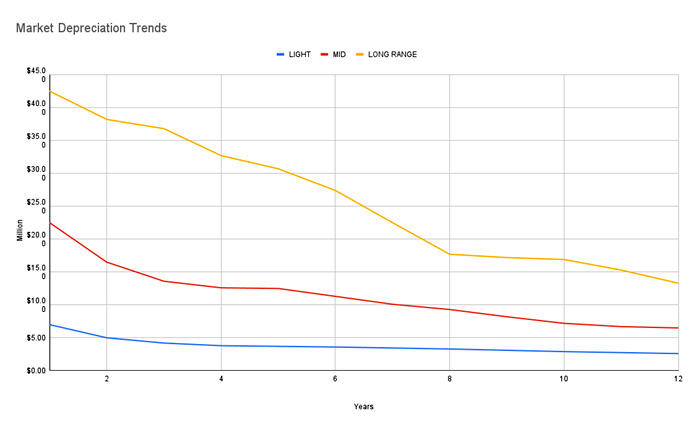

With the present fleet in India and its utilisation rate, the best that can be produced is less than 50 per cent of the potential market demand. What is actually on offer is even less. The present average fleet age of business jets offered for Private Charters in India is above 15 years. Compare this with an average age of under 6 years for globally established players such as NetJets and Vista jet and others in Europe. This is also one of the reasons for poor utilisation rate in that the maintenance requirements and downtime rise exponentially with age above 12-13 years. Particularly, in the light and mid-jet segment, obsolescence management is another challenge. While in the bigger jets depreciation is high, in the smaller ones it is the obsolescence that has to be managed. A high fleet age suggests that business has not been lucrative enough for the businesses to invest in newer aeroplanes and operators have been too occupied managing the plane and cash flow rather than managing the lifecycle cost of the machine. This is also partly due to an inadequate understanding of Life Cycle management. The demand-supply gap is nearly 30 per cent in the existing market and over 100 per cent in the potential market with supply being way short of what it should be. The current ownership pattern in India is also not conducive for operators to make commitments in advance. This further kills steady supply. Since long-term order books are not certain, operators tend to focus on cash flow rather than any long-term strategy. Ultimately, the whole system revolves around uncertain supply thereby not allowing a growth-oriented business plan.

Private air travel bookings in India are done on Whatsapp in over 140 Whatsapp groups. Multiple levels of the brokerage with little transparency coupled with supply gaps drive the prices exponentially.

Distribution

While the supply has its challenges, the distribution of the service has remained one of the most unregulated and inaccessible aspects of private air travel in India. While the operators are heavily regulated, the air charter brokers have no requirements at all. In India to be a train ticket booking agent requires more regulatory approvals than an air charter broker. Globally air charter brokers fulfil an important role in the distribution chain which involves legal, contractual and experience fulfilment. There are commercial rating agencies that make sure that the industry runs as per laid down standards. In India, the distribution chain of private air travel is completely inaccessible to the potential market. In the country that boasts as the largest supplier of IT services globally, private air travel bookings are done on Whatsapp in over 140 Whatsapp groups. Multiple levels of the brokerage with little transparency coupled with supply gaps drive the prices exponentially. With this kind of distribution ecosystem, it is not possible to tap the potential private air travel market which is price sensitive and demands a high quality of service and transparency. Unless this changes nothing else can work.

An organised distribution which allows the sale of Empty Legs or minimises/avoids two-way pricing not only makes the service more accessible but also affordable in the on-demand market.

What can be done?

Step 1

"Make it Accessible and Affordable"

Every problem requires some short-term and some long-term measures. Even in the existing market, there is a supply deficit of over 20 per cent. Fulfilling this deficit should be the first step in the short term. The average flying per aeroplane of Global heavyweights is over 1000 hrs. Flying over 1000 hours covers the depreciation partially and allows timely addition and replacement of the machine to keep the business growing. In India, the average flying is under 600 hrs in the Jet Category. An increase of 20-25 per cent over the existing flying hours can partially fulfil the existing demand-supply gap. This is achievable by small measures such as a more organised and transparent distribution mechanism and collaboration between operators with the same fleet. A tech-enabled distribution can easily increase aeroplane utilisation. Due to the aeroplane ownership structure in India, owner requirements would always limit the utilisation rate of most planes but a 20-25 per cent increase is always achievable with the same serviceability levels but with collaboration between operators of the same type and tech enablement of distribution. An organised distribution which allows the sale of Empty Legs or minimises/avoids two-way pricing not only makes the service more accessible but also affordable in the on-demand market.

A fractional ownership model that offers a very low fraction with assured flying would increase the market size substantially

Step 2

"Increase Capacity and Market Penetration"

In the long term, drastically improving the average age and addition of aeroplanes would allow penetration into the untapped market. In this context, a fractional ownership model that offers a very low fraction with assured flying would increase the market size substantially. The residual hours can then be sold as jet cards or on demand. The fractional ownership model is heavily dependent on scale and sale of residual hours via Jet Cards or in the on-demand market. Although prior attempts for fractional ownership in different forms have been made, they didn't get much success and the planes acquired then are still in service after 15 years. A small size of the minimum fraction with a small commitment period would allow a larger portion of the market to adopt private travel due to low-risk exposure. The low fraction would allow a substantial supply to be released to the on-demand market thereby facilitating long-term sales.

Flying more than 1000 hrs per plane per year requires an organised business and an organised ecosystem that is transparent and competitive.

For a Fleet of 5-6 Light jets with per aircraft flying of 1000 hrs a year the effective travel price for a Regular Fractional Owner with 200 hrs of commitment every year can be as low as just 4 times of the Business Class travel (with at least 30 per cent seat occupancy - not on seat sharing) which at present is more than 16 times. That is almost a 75 per cent reduction in price point. When an Indian Business Model can execute this - India would have arrived on the scene. Achieving this is not easy. Flying more than 1000 hrs per plane per year requires an organised business and an organised ecosystem that is transparent and competitive.

Conclusion

Essentially, the future of Business Aviation Growth in India is critically dependent on a single factor -

'The ability of the Industry to Organise itself'.

Captain Abhishek Sinha saw the adverse implications of the unorganized and inefficient business aviation industry and thus he created a platform that can make air charter deals easier. Operators post the availability of their planes and air charter brokers post their trip requirements. Upon finding a relevant match on the platform engine they can have direct conversations with one another to finalise the deal. On the platform, air charter operators can enhance the utilisation of their aircraft's flying hours. On the other hand, air charter brokers can find the best air charter deals for their end clients at a great price.

A revolution is long-awaited to give a quick spin to the air charter industry in India and making it a growth-oriented business is the need of the hour.