Regional Aircraft for India

The next round of growth in the Indian airline industry will be triggered by expansion of regional aviation into remote and not easily accessible regions.

Soon after coming into power, hopes of the crisis ridden civil aviation industry in India went soaring when the Narendra Modi Government turned its attention to this perhaps most neglected sector in the country. The focus of the new government to begin with was on airport development and air connectivity, two areas that are critical in the years to come for the growth and well-being of the Indian civil aviation industry in general and the Indian airline industry in particular. In fact, the government was embarked on drafting a new civil aviation policy that would be comprehensive and would incorporate far-reaching changes crafted to have beneficial impact on regional aviation within the country. In fact in September this year, the government even initiated a dialogue with all the stakeholders on the new comprehensive civil aviation policy. However, in the second week of October, the spirits of the Indian airline industry were dampened somewhat when they received the news that V. Somasundaram, Secretary, Ministry of Civil Aviation (MoCA), had approved the deferment of the policy on regional and remote area air connectivity until further orders. Hopefully, the deferment is going to be short-lived.

The State of the Indian Airline Industry

Having lost $10.6 billion in the last seven years and currently languishing under the crushing burden of a combined debt of $15.83 billion, the plight of the Indian airline industry is disconcerting indeed. This segment of the industry has suffered the triple onslaught of high airport charges, exorbitant tax on aviation turbine fuel (ATF) and a slowdown in the rate of growth in domestic passenger traffic. The MoCA expects domestic carriers to enhance the number of flights to the smaller cities normally referred to as Tier-II, Tier-III and Tier-IV cities. These routes are generally regarded unprofitable.

India is emerging as an important economic entity in the world and if assessment by PricewaterhouseCoopers (PwC), an accountancy firm of global repute based in London, is to be relied upon, the nation is moving decisively to overtake the United Kingdom to become the third largest economy in the world after the United States and China. It is a well established fact that the civil aviation industry is a major contributor to economic growth of a nation. Unfortunately growth in the Indian civil aviation industry has been lagging behind the resurgence in the Indian economy. One of the indices of the extent to which the Indian civil aviation industry is lagging behind the growth in the national economy is the degree of penetration amongst the population in respect of air travel. In India, only around three per cent of the population of 1.3 billion avail of the facility of air travel. While the majority are unable to travel by air on account of the prohibitively high cost, there is a large segment of the population that can afford air travel but is unable to do so because of lack of access to this facility. The nature of the problem can be best appreciated through a comparison between the present state of airport infrastructure as well as the size of commercial fleets available in the US against that in India. With a population that is under 25 per cent of that of India, the US has around 15,000 functional airports as against 132 in India. As for comparison of the number of commercial aircraft in operation, the total number of airliners in India is just under 400 as against around17,000 in the US. These figures clearly reflect the enormous scope there is for growth in the airline industry of India, a nation aspiring to catch up with the US economically as well as reach greater heights of glory in the regime of civil aviation.

Prospects of Growth

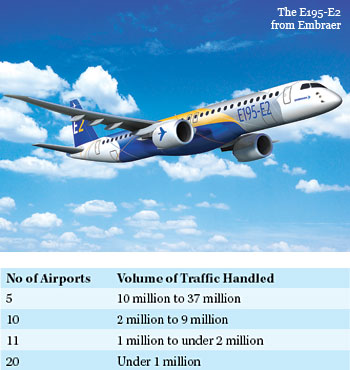

As per assessment by KPMG and the Federation of Indian Chambers of Commerce and Industry (FICCI), by 2020, India has the potential to become the third largest aviation market in the world and could even emerge as the largest by 2030. However, for these aspirations to be translated into reality, the government would have to seriously evaluate the true potential of this sector and institute measures for its exploitation. The government would have to initiate measures simultaneously in the different areas of the Indian aviation industry. But the most important area would be that of airport infrastructure development in the Tier-II, Tier-III and Tier-IV cities. Currently bulk of the passenger traffic flows between the metros or between the metros and other large non-metro cities. In all, there are just about 36 airports out of the 132 that handle most of the passenger traffic in the country and these routes are nearly saturated. The annual passenger traffic handled by the 36 busiest airports in the country are as under.

From the chart alongside it appears that bulk of the passenger traffic in India is handled by 15 airports. It should be obvious therefore that to maintain a respectable growth trajectory in the Indian airline industry, aerial connectivity needs to be expanded and provided to those towns and cities where such a facility does not currently exist. Just as an example, amongst the seven North Eastern states, two of the state capitals do not have aerial connectivity at all. Also as rail and road connectivity to and amongst the North Eastern states is also extremely poor, the entire North East region has a huge requirement for air connectivity for its effective economic integration with the rest of the nation. The poor state of road, rail and aerial connectivity has served to impede the economic development of the region which is resource rich and is endowed with tremendous economic potential. The next round of growth in the Indian airline industry will be triggered by expansion of regional aviation into remote and not easily accessible regions. These areas would add huge volumes of passenger traffic hitherto unexploited owing to lack of air connectivity. However, this would require reactivation of the 300 odd unused airstrips spread in all parts of the country and provide them with terminals with basic facilities as well as building of a large number of new low-cost, no-frill Greenfield airports that can operate not only small turboprop aircraft; but also medium size, single aisle regional jets. It goes without saying that this will spur the market in India for regional airliners. What will be important is that the airliner selected to fuel the growth of regional aviation, is of the right size.

Enter the E2 Jets from Embraer

Regional connectivity on the Indian commercial aviation scene has been dominated from the very beginning by twin-engine turboprop aircraft such as the ATR-42 and the ATR-72, both French products of renown. These aircraft have a passenger capacity ranging between 50 and 70 and compared to jet airliners such as the Boeing 737 and the Airbus A320 class of single-aisle airliners, are far more economical to operate on short routes. These aircraft are also capable of operating from runways of around 1,300 metres in length, much shorter than the 1,800 metres long runway required by the Boeing 737 or the 1,500 metres long runway required for the Airbus A320 single-aisle jet airliner. Later the ATRs were to face severe competition from the twin-engine Q-400 from Bombardier of Canada, a more powerful turboprop airliner nearly in the same class as the ATRs. The Bombardier Q-400 can carry between 68 and 78 passengers.

Between the turboprop and the Boeing 737 or Airbus A320 class single-aisle jet airliners, there is now available the E-2 family of single-aisle passenger jets from Embraer of Brazil. Designated as the E-175 E2 and the E-195 E2, this family of E-Jets have a capacity of 80 passengers on the E-175 going up to 110 on the E-195 could provide the answer to cost effective regional connectivity in the new scheme of things the MoCA is working on. At their maximum take-off weight, the Embraer E-2 regional jets can provide connectivity between airports located up to 900 nautical miles apart. Such distances are too large to be served economically by turboprops. The E-2 jets can also comfortably operate from runways that are suitable for the regional turboprops such as the ATRs and the Q-400.

As for the economics of operations, the E-195-E2 jets are reported to be around 20 per cent less expensive in terms of seat mile costs as compared to the Boeing 737 or the Airbus A320. As per Mark Dunnachie, Commercial Aviation Vice President for the Asia-Pacific region, “Even the cost of operating an E-175-E2 will be cheaper per seat mile as compared to turbo-propeller aircraft.” Embraer E-Jets have been immensely successful in their own home turf in Brazil where with a fleet of E-Jets, Azul Airlines has established efficient regional connectivity amongst the smaller or secondary cities competing successfully against the Boeing 737 and Airbus A320s that have not proved to be profitable. In India, the newly launched Vijayawada-based regional airline Air Costa serves a network of secondary markets with smaller capacity 100-seat Embraer E-Jets and avoids direct competition with those airlines operating the Boeing 737 or the Airbus A320 on heavily subscribed routes. As per Ramesh Lingamaneni, Executive Director of the LEPL Group and Chairman of Air Costa, “Regional air services have enormous potential in India especially those connecting Tier-I, Tier-II and Tier-III cities. Our initial experience with our fleet of Embraer E-Jets has been very positive.” Air Costa has a firm order for 50 Embraer E2 aircraft with an option for another 50 planes. The order, both firm and option, is equally divided between Embraer’s E-190-E2 and E-195-E2 jets.

For a healthy and rapid growth of regional aviation in India, getting the right aircraft will be a critical factor.