Battle between Speed & Economy: Regional Jets Vs Turboprops

The regional jet market is trending towards larger 100-/150-seat airplanes like the second generation Embraer E-Jets and the CSeries blurring the boundaries between regional and mainline

An aircraft is designed around mission requirements, namely passenger capacity, required range, airfield accessibility and operating economics. Based on these requirements, short- to medium-haul aircraft can be classified either as regional or mainline.

Regional aviation aircraft initially powered by piston engines were replaced by turboprop aircraft that provided higher reliability with equivalent or better operating economy. As turbofan engines improved in efficiency, jetliners with similar capacity as turboprop regional aircraft, narrowed the operating economy gap while emerging as preferred option as these provided better comfort, higher speed and better aircraft utilisation rate. This spawned the birth of the regional jetliner.

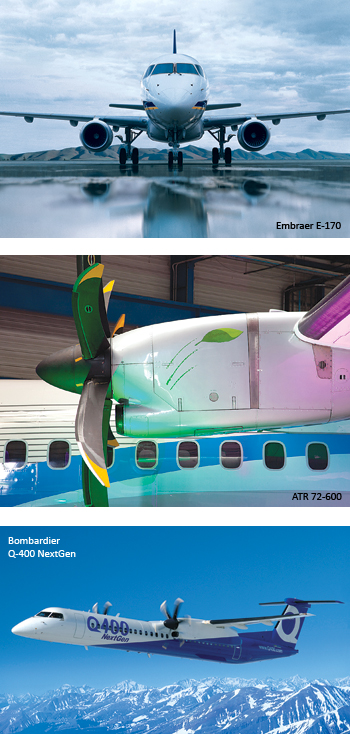

The first set of 50-seat regional jetliners, the CRJ-100/200 from Bombardier and EMB-135/145 from Embraer, eventually gave way to larger capacity jetliner namely the Embraer ERJ-170/175 and the CRJ-700, both of which had taken to the skies in 1999. With the expansion of airlines, the hub-and-spoke model was challenged with these aircraft of regional capacity (70-80 seats) and mainline range (1,000 to 2,000 nm), which promised direct regional airfield connectivity as “long, thin routes”. The ATR 72 regional turboprop with 72 seats, could fly only 800 nm.

To bridge the gap between these new regional jet offerings and the turboprop, Bombardier introduced the DHC-8-400 which in 1999 became the Q-400. This aircraft provided slightly greater range, speed and capacity but with the unrivalled operating economics of a turboprop.

Post-9/11, airlines entered bankruptcy and with fuel prices skyrocketing, the focus shifted to lower-operating costs over anything else. This somewhat diminished the attractiveness of regional jetliners.

Economics of a Turboprop

A regional aircraft is designed to operate from airfields challenged by runway length and surrounding terrain where high thrust, high-lift wings and low all-up weights are prerequisites. High-lift wings produce significant lift at low speeds, but add drag at higher speeds. The required thrust can be achieved by accelerating either a large mass of air to a low speed as with a propeller or a small mass of air to a high speed as in a jet engine. The highest propulsive efficiency is achieved when the speed of the exhaust is close to the airspeed of the aircraft. For high-lift, low speed wings, the low exhaust speed option offered by large diameter propellers, is the natural choice. Turboprop aircraft quickly reach the speed at which the efficiencies are the best and usually do not climb above 25,000 ft. The lower speed provides for lower drag and the massive, variable pitch propellers offer unparalleled efficiencies.

A turbojet and a turbofan powered aircraft, on the other hand, need to climb to higher altitudes at which the drag is lower allowing acceleration to high speeds at which the engine is most efficient. However, the higher speeds results in higher drag requiring higher thrust-to-speed ratios.

Successful low-cost airlines have reposed faith in the economics and routeing benefits of the hub-and-spoke model. With such a model, most regional routes are typically 200-300 nm in length, especially in Asia, which is the aviation market with the largest growth. With such short distances, regional jets spend lesser time at their most efficient altitudes and speeds in contrast to turboprops which fly optimal speeds for longer durations.

To promote regional aviation, landing fees are waived for aircraft weighing less than 40,000 kg all-up-weight, operating for a scheduled airline. In addition, a flat four per cent service tax on aviation turbine fuel (ATF) is levied upon aircraft with less than 80 seats that fly for a scheduled airline. All regional jets and turboprops with under 80 seats weighing less than 40 tonnes, benefit from these policies.

Flexibility

At maximum weights, the ERJ-170 and the CRJ-700 require between 5,000 feet and 5,600 feet of runway. The Q-400, at its maximum weight requires 4,800 feet of runway, while the ATR 72 requires 4,300 feet of runway. Regional destinations such as Pondicherry have a 4,500 feet runway, which comfortably accommodates the ATR 72, imposes load or range restrictions on the Q-400 due to lower uplifted fuel; but greater restrictions on the regional jets.

The longer range of the regional jets, 1,000 nm to 2,000 nm, is sold as “lending flexibility” to routes and network. No customer the world over has ever complained of additional range. However, with most regional routes not exceeding 300 nm, due to the popularly adopted hub-and-spoke model, the benefit of longer range is not sufficient to attract operators.

Operating Economics

The ATR 72 is the lesser of the two turboprops in performance, but displays better fuel economy. For a typical Bengaluru-Hyderabad sector, which is 250 nm, the aircraft consumes approximately 770 kg of fuel. The Q-400 consumes close to 1,000 kg, the CRJ-700 consumes close to 1,200 kg, and the Embraer E-170 1,300 kg; all three aircraft carrying 78 passengers. Fuel consumption for the regional jets will operationally be lower, as even with a full passenger load, the fuel burnt for a 250 nm trip is just 10-13 per cent of the tank capacity, keeping the aircraft close to 4,000 kg lighter than the maximum take-off weight and thus burning lesser fuel.

Fuel is the largest cost differentiator between turboprops and regional jets. Being in similar weight categories, operating similar sectors, landing and parking fees are similar. Considering that the faster turboprop and the much faster jets can squeeze in extra flights per day, the maintenance costs go up, but so does revenue generation.

Geared turbofan engines (GTF), which will power the Bombardier CSeries, the second generation Embraer EJets and the Airbus neo, offer greater fuel economies. However, no GTF airplane in the 70-90 seat segment is expected in the coming few years and even a GTF powered aircraft cannot outperform the turboprop’s economics.

Utilization

On a 300 nm sector, a regional jet can save as much as 20 minutes when compared to the ATR 72 and 7-10 minutes when compared to the Q-400. In a typical day starting at 6 a.m. and ending at 10 p.m., a turboprop like the ATR 72 can fly eight 300 nm sectors, the Q-400 nine sectors, while a regional jet can fly ten sectors. This allows a 78-seat regional jet to fly more passengers per day, promises greater fleet utilisation and a larger network/frequency with a smaller fleet of airplanes.

Passenger Perception

Many in the industry point out to the passenger’s preference to fly in a jet, owing to the speed, comfort, lower noise level and the perception of a jet as modern and safe and turboprop as old and unreliable. This indirectly affects the airline’s sales, but not as much in India and most of Asia, which is primarily a cost-driven market. Said Michael O’Leary, CEO of the famous successful Irish low-cost airline Ryanair, that 99 per cent of his customers have no idea of what model or make of plane they are travelling in.

Purchase Price and Market

The ATR 72-600 is listed at $25 million, the Q-400 at $27 million, the E-170 at $26.5 million and the CRJ-700NextGen at close to $25 million. This makes jets attractive on two grounds: the acquisition cost and because of the competing regional jets’ lower demand, used E-170 and the CRJ-700 are available for very attractive lease and purchase rates, making them ideal for startup airlines.

So low is the demand for 70-/80- seat regional jets that established leasing companies do not deal with these jets. The Indian regional startup, Air Costa, picked up two Embraer E-170 jets from Embraer’s in-house leasing, ECC. The rates were so attractive that the airline abandoned its original plan for Q-400s. In contrast, established leasing companies deal with the ATR 72-600 and the Q-400. Air Pegasus, a yet-to-start Bengaluru-based regional airline, has firmed up plans for an all ATR 72 fleet.

In 2013, only one CRJ-700 and four E-70s were delivered, while almost nil orders were secured in the same year. In contrast, 67 ATR 72-600 and 29 Q-400s were delivered in 2013, while 79 ATR 72-600 and 17 Q-400 orders were placed.This portends the future of the 70-/80-seat regional jet market.

Further Development

The regional jet market is trending towards larger 100-/150-seat airplanes like the second generation Embraer E-Jets and the CSeries blurring the boundaries between regional and mainline, while abandoning competition in the turboprop landscape, leaving a gap between existing 70-/80-seat turboprops and the 100-seat jet.

ATR has been actively studying a 90-seat turboprop that will be attractive to regional operators. Realising its market potential, India and China have also been working on one such type. ATR, identifying the market gap, is pushing to start the programme in 2014. At the last Paris Airshow, ATR’s CEO Filippo Bagnato said, in the context of the clean-sheet large turboprop design, “We have been able to sell more than 300 aircraft since the launch of the -600 versions of the ATR 72 and ATR 42. The market pays attention to manufacturers that renew their aircraft.”

The turboprop market is modestly big with the yearly growth in sales that only validates the operating economics of such aircraft. However, with two manufacturers selling close to 100 turboprops in 2013, the market is not big enough to accommodate a third manufacturer: Embraer, which had, at one point of time, mulled a return to the turboprop market.

“Typically speaking when the fuel price is high, everyone starts focusing on turboprops, when fuel price drops, turboprops become a niche programme”, said President of Embraer Aviation Europe, Luiz Fuchs, in early 2012.

The developments surrounding regional jets and turboprops is much like the story of the hare and the tortoise.