Passenger demands plummet, airlines likely to face a serious cash burn: IATA

Swift actions from governments worldwide is a necessity in this darkest hour for aviation, else the airlines may burn through $61 billion of their cash reserves during the second quarter of 2020, according to IATA.

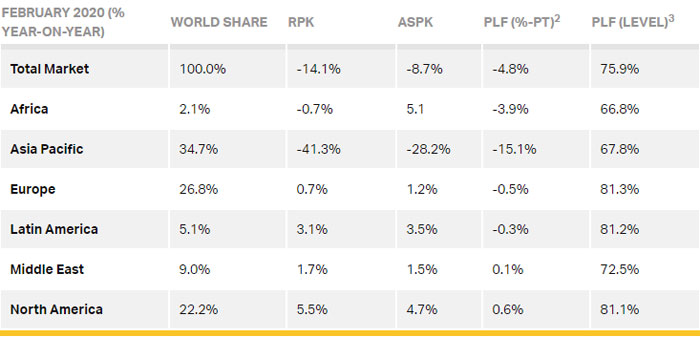

As the first quarter of 2020 came to an end, the International Air Transport Association (IATA) stated that passenger demand plunged due to COVID-19 travel restrictions. IATA is the global trade association for the airline industry, representing 300 member airlines worldwide. The association announced global passenger traffic data for February 2020 showing that demand (measured in total revenue passenger kilometers or RPKs) fell 14.1 per cent compared to February 2019. This was the steepest decline in traffic since 9/11 and reflected collapsing domestic travel in China and sharply falling international demand to/from and within the Asia-Pacific region, as a result of the spreading COVID-19 virus and government-imposed travel restrictions. February capacity (available seat kilometers or ASKs) fell 8.7 per cent as airlines scrambled to trim capacity in line with plunging traffic, and load factor fell 4.8 percentage points to 75.9 per cent, stated IATA.

Speaking on these issues, Alexandre de Juniac, IATA’s Director General and CEO said, “Airlines were hit by a sledgehammer called COVID-19 in February. Borders were closed in an effort to stop the spread of the virus. And the impact on aviation has left airlines with little to do except cut costs and take emergency measures in an attempt to survive in these extraordinary circumstances. The 14.1 per cent global fall in demand is severe, but for carriers in Asia-Pacific the drop was 41 per cent. And it has only grown worse. Without a doubt this is the biggest crisis that the industry has ever faced.”

INTERNATIONAL PASSENGER MARKETS

Highlighting the status of international passenger markets, IATA also pointed out that February international passenger demand fell 10.1 per cent compared to February 2019, the worst outcome since the 2003 SARS outbreak and a reversal from the 2.6 per cent traffic increase recorded in January. Europe and Middle East were the only regions to see a year-over-year traffic rise, while capacity fell 5 per cent, and load factor dropped 4.2 percentage points to 75.3 per cent.

Source: IATA

Source: IATA

February traffic among Asia-Pacific airlines dropped down 30.4 per cent compared to the year-ago period, steeply reversing a 3 per cent gain recorded in January. Capacity fell 16.9 per cent and load factor collapsed to 67.9 per cent, a 13.2-percentage point fall compared to February 2019.

Highlighting the status of international passenger markets, IATA also pointed out that February international passenger demand fell 10.1 per cent compared to February 2019, the worst outcome since the 2003 SARS outbreak and a reversal from the 2.6 per cent traffic increase recorded in January.

For the European carriers, February demand was virtually flat compared to a year ago (+0.2 per cent), the region’s weakest performance in a decade. As international entry restrictions hit home and volumes on Asia-North America routes plunged 30 per cent, North American carriers faced a 2.8 per cent traffic decline in February, reversing a 2.9 per cent gain in January.

Latin American airlines experienced a 0.4 per cent demand drop in February compared to the same month last year. While African airlines’ traffic slipped 1.1 per cent in February, versus a 5.6 per cent traffic increase recorded in January and the weakest outcome since 2015. Middle Eastern airlines, however, posted a 1.6 per cent traffic increase in February, but even that was a slowdown from the 5.3 per cent year-over-year growth reported in January.

DOMESTIC PASSENGER MARKETS

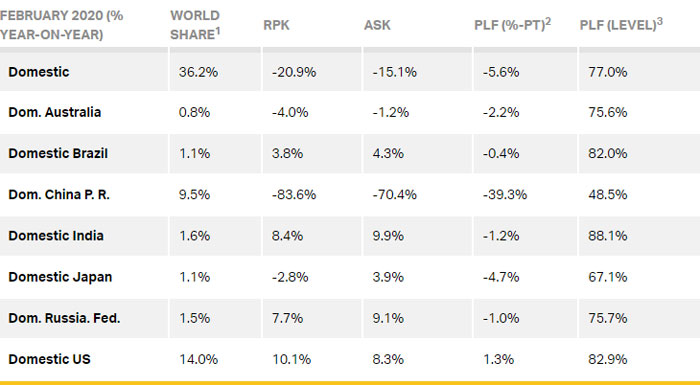

Showcasing the impact of the virus within domestic passenger markets, demand for domestic travel dropped 20.9 per cent in February compared to February 2019, as Chinese domestic market collapsed in the face of the government lockdown. Domestic capacity fell 15.1 per cent and load factor dropped 5.6 percentage points to 77 per cent.

Source: IATA

Source: IATA

While these February estimates already showed how worse hit the aviation industry is, the full impact of COVID-19 is expected to show in March results as the virus has continued to spread around enhancing restrictions and lockdowns.

“This is aviation’s darkest hour and it is difficult to see a sunrise ahead unless governments do more to support the industry through this unprecedented global crisis. We are grateful to those that have stepped up with relief measures, but many more need to do so. Our most recent analysis shows that airlines may burn through $61 billion of their cash reserves during the second quarter ending 30 June 2020. This includes $35 billion in sold-but-unused tickets as a result of massive flight cancellations owing to government-imposed travel restrictions. We welcome the actions of those regulators who have relaxed rules so as to permit airlines to issue travel vouchers in lieu of refunds for unused tickets; and we urge others to do the same. Air transport will play a much-needed role in supporting the inevitable recovery. But without additional government action today, the industry will not be in a position to help when skies are brighter tomorrow,” said de Juniac.

DELAYED RECOVERY

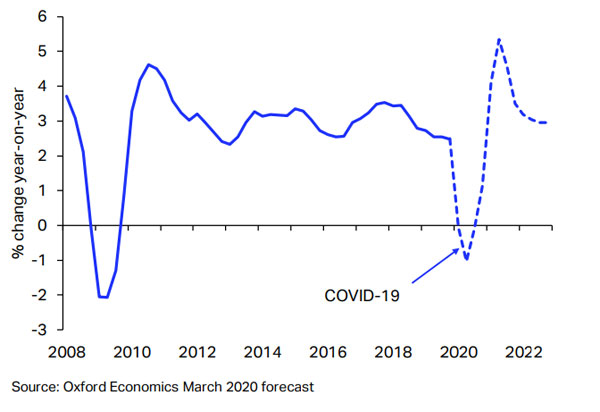

IATA has also underlined that the rebound in air travel after COVID-19 is expected to take longer than the recovery seen after pandemics in the past. The key differences compared with historical episodes are the unprecedented travel restrictions around the world and the global recession which has been triggered as businesses and borders are closed. The latter is likely to lead to higher unemployment, lower business confidence and a fall in consumer spending – all of these factors will contribute to a delayed recovery in air travel demand.

Global GDP growth forecast

Depending on the current developments, and notwithstanding the high level of ongoing uncertainty regarding the pandemic, IATA estimates that industry-wide RPKs will contract by almost 40 per cent in 2020, with the decline broad-based across all regions. It is not very surprising to note, the global economic environment is highly unsupportive of air travel.

On top of unavoidable costs, airlines are faced with refunding sold but unused tickets as a result of massive cancellations resulting from government-imposed restrictions on travel. The second quarter liability for these is a colossal $35 billion.

Domestic RPKs contracted by more than 20 per cent year-on-year (YoY) in February on a weak performance of key markets in the Asia-Pacific region, particularly China. But it was not all negative news in February. US domestic RPKs rose by 10 per cent YoY. RPKs also picked up in India (up 8.4 per cent YoY) as local carriers boosted air travel demand by lowering airfares in the typically weak travel season. Russian domestic RPKs also performed solidly, recording an 8-month high growth rate (7.7 per cent YoY).

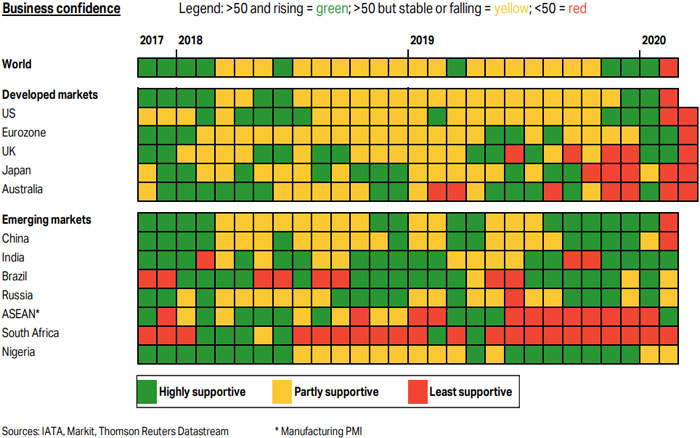

CHART: Economic conditions (monthly data from composite PMIs, selected regions and countries)

However, the global as well as regional and individual country-level business indicators have largely deteriorated in February. And as the virus has continued to spread around the world, taking its toll on business activity, similar outcomes are expected in more countries.

SEVERE CASH BURN FOR AIRLINES

IATA also published a recent analysis showing that airlines may burn through $61 billion of their cash reserves during the second quarter ending June 30, 2020, while posting a quarterly net loss of $39 billion.

Juniac remarked, “As you know, we have been working from a scenario of severe travel restrictions lasting for three months. That will cut industry revenues by $252 billion in 2020 compared to 2019. The dimension of this crisis is beyond anything that the industry has experienced. When borders are closed and people’s mobility is limited by governments, our business disappears. And, of course if we cannot move people, that impact is felt across the economy, not least of which in the tourism sector. And when 70 per cent of your business vanishes overnight, there is no amount of cost cutting that can adequately fill the gap.”

IATA estimates that COVID-19 could result in a 9 per cent loss in passenger volumes and US$2.1 billion loss in passenger base revenues for the air transport market in India in 2020. The association also brought to notice that the disruptions in air travel from COVID-19 could reduce about 575,000 jobs and US$3.2 billion in GDP supported by the air transport industry in India.

This analysis is based on the impact assessment IATA released at the end of March, under a scenario in which severe travel restrictions last for three months. In this scenario, full-year demand falls by 38 per cent and the fall in demand would be the deepest in the second quarter, with a 71 per cent drop.

The impact is expected to be severe due to the following factors:

- Revenues are expected to fall by 68 per cent. This is less than the expected 71 per cent fall in demand due to the continuation of cargo operations, albeit at reduced levels of activity.

- Variable costs are expected to drop sharply—by some 70 per cent in the second quarter—largely in line with the reduction of an expected 65 per cent cut in second quarter capacity. The price of jet fuel has also fallen sharply, although it is estimated that fuel hedging will limit the benefit to a 31 per cent decline.

- Fixed and semi-fixed costs amount to nearly half an airline’s cost. We expect semi-fixed costs (including crew costs) to be reduced by a third. Airlines are cutting what they can, while trying to preserve their workforce and businesses for the future recovery.

These changes to revenues and costs result in an estimated net loss of $39 billion in the second quarter.

On top of unavoidable costs, airlines are faced with refunding sold but unused tickets as a result of massive cancellations resulting from government-imposed restrictions on travel. The second quarter liability for these is a colossal $35 billion.

“Airlines cannot cut costs fast enough to stay ahead of the impact of this crisis. We are looking at a devastating net loss of $39 billion in the second quarter. The impact of that on cash burn will be amplified by a $35 billion liability for potential ticket refunds. Without relief, the industry’s cash position could deteriorate by $61 billion in the second quarter,” pointed out Juniac.

IATA SEEKS GOVERNMENT ACTION

IATA is urging Asia-Pacific states to take urgent action to provide financial support to their airline industry impacted by the COVID-19 crisis.

“Travel and tourism is essentially shut down in an extraordinary and unprecedented situation. Airlines need working capital to sustain their businesses through the extreme volatility. Canada, Colombia, and the Netherlands are giving a major boost to the sector’s stability by enabling airlines to offer vouchers in place of cash refunds. This is a vital time buffer so that the sector can continue to function. In turn, that will help preserve the sector’s ability to deliver the cargo shipments that are vital today and the long-term connectivity that travelers and economies will depend on in the recovery phase,” said Juniac.

Major Asia-Pacific states could see passenger demand in 2020 reduced to 34 per cent to 44 per cent. This is based on a scenario where severe restrictions on travel are lifted after 3 months, followed by gradual recovery.

“Based on a scenario in which severe travel restrictions last for three months, the Asia-Pacific region as a whole will see passenger demand reduced by 37 per cent this year, with a revenue loss of US$88 billion. While each country will see varying impact on passenger demand, the net result is the same – their airlines are fighting for survival, they are facing a liquidity crisis, and they will need financial relief urgently to sustain their businesses through this volatile situation,” said Conrad Clifford, IATA’s Regional Vice President, Asia-Pacific.

Australia, New Zealand and Singapore have announced a substantial package of measures to support their aviation industry. “But others in the region, including India, Indonesia, Japan, Malaysia, the Philippines, Republic of Korea, Sri Lanka and Thailand, have yet to take decisive and effective action. Jobs as well as the GDP supported by the industry are at risk,” said Clifford.

“Governments need to ensure that airlines have sufficient cash flow to tide them over this period, by providing direct financial support, facilitating loans, loan guarantees, and support for the corporate bond market. Taxes, levies, and airport and aeronautical charges for the industry should also be fully or partially waived. It is critical that these countries still have a viable aviation sector to support the economic recovery, connect manufacturing hubs and support tourism when the COVID-19 crisis is over. They need to act now – and urgently - before it is too late,” said Clifford.

IATA also strengthened its call for urgent action from governments in Africa and the Middle East to provide financial relief to airlines as the latest IATA scenario for potential revenue loss by carriers in Africa and the Middle East reached US$23 billion (US$19 billion in the Middle East and US$4 billion in Africa). This translates into a drop of industry revenues of 32 per cent for Africa and 39 per cent for the Middle East for 2020 as compared to 2019.

IATA REACHES OUT TO THE INDIAN GOVERNMENT

IATA also wrote a letter to the Prime Minister of India highlighting the gravity of this situation for the aviation industry. The letter mentioned that based on IATA’s analysis of the impact of the outbreak on airlines around the world, it is very clear that the COVID-19 pandemic is challenging the viability of the global air transport system as never before in history.

“The current industry crisis is much worse and more widespread than 9/11, SARS or the Global Financial Crisis. Prior to the outbreak of COVID-19, India‘s air transport industry’s economic contribution was estimated at US$35 billion, supporting 6.2 million jobs and contributing 1.5 per cent to GDP in India. However, COVID-19 has led to the destruction of air travel demand on an unprecedented scale. Travel restrictions and other measures adopted by governments have made most international air services economically unviable or operationally impossible, resulting in a rapid shrinking of the global air transport network,” the letter read.

IATA estimates that COVID-19 could result in a 9 per cent loss in passenger volumes and US$2.1 billion loss in passenger base revenues for the air transport market in India in 2020. The association also brought to notice that the disruptions in air travel from COVID-19 could reduce about 575,000 jobs and US$3.2 billion in GDP supported by the air transport industry in India. Also highlighting the airlines’ risk of running out of cash in the very near future, IATA stated that unless government action is taken now, the post-pandemic economic recovery in India would be seriously impeded.

Stating that the Indian government has the tools to prevent the loss of India’s essential air transport connectivity by urgently providing or facilitating the provision of financial support, IATA has suggested the following immediate as well as medium- to long-term assistance that can be provided to the airlines and its employees:

- Direct financial support to compensate for reduced revenues and liquidity attributable to travel restrictions imposed as a result of COVID-19.

- Loans, loan guarantees and support for the corporate bond market by the government or Central Bank, either directly to the airlines or to commercial banks that may be reluctant to extend credit to airlines in the present situation in the absence of such a guarantee. The corporate bond market is a vital source of cash, but the eligibility of corporate bonds for central bank support needs to be extended and guaranteed by the government to provide access.

- Tax relief: Rebates on payroll taxes paid to date in 2020 and/or an extension of payment terms for the rest of 2020, along with a temporary waiver of ticket taxes and other government-imposed levies. Additionally, steps such as temporary reduction of excise duty on ATF; fuel credit to be offered to airlines; waiving of airport charges – could give the aviation sector in India the critically needed relief to be able to survive through this crisis. These measures are required urgently and, in order to be successful, all of them need to be included in a comprehensive rescue package. Financial support is likely to be needed for at least six months, possibly longer, depending on the duration of the outbreak.